Oh boy, do we have a treat for all you tax-loving folks out there! We’ve got our hands on the latest updated version of the IRS Form W-9, and you better believe it’s as printable as it gets!

Check Out This W-9 Printable Form!

Now, we know what you’re thinking. “A printable tax form? How exciting.” But trust us, this W-9 form is worth getting excited about! It’s the latest and greatest version, updated and ready to be filled out to your heart’s content.

Now, we know what you’re thinking. “A printable tax form? How exciting.” But trust us, this W-9 form is worth getting excited about! It’s the latest and greatest version, updated and ready to be filled out to your heart’s content.

What Is the IRS Form W-9?

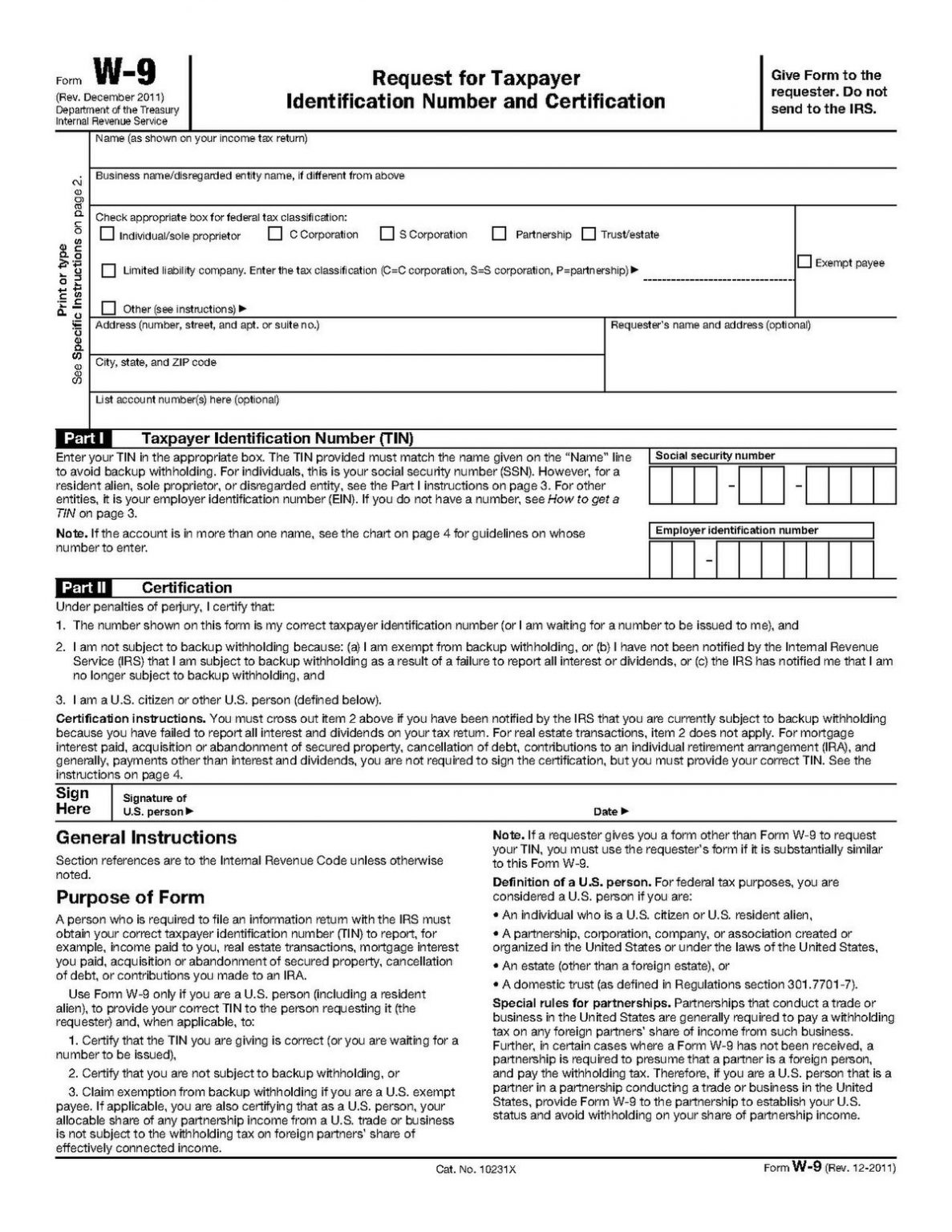

For those of you who may not be familiar with the W-9 form, let us break it down for you. The W-9 form is used by businesses to request information from independent contractors or freelancers they have hired. Specifically, the form asks for the contractor’s Taxpayer Identification Number (TIN), which could be their Social Security Number (SSN) or their Employer Identification Number (EIN).

Now, we know what you’re thinking. “Great, another tedious tax form to fill out.” But the good news is that the W-9 form is actually pretty simple and straightforward. It only has a few fields to fill out, and most people can complete it in just a few minutes.

How to Fill Out the W-9 Form

Alright, are you ready to get down to business and fill out this bad boy? Let’s do this!

First up, you’ll need to download the W-9 form from the IRS website or from a trusted source like, ahem, the one we’ve provided above. Once you’ve got the form downloaded, you can print it out and get ready to fill in the blanks.

Step 1: Enter Your Name

The first field on the W-9 form is for your name. Pretty straightforward, right? Just enter your legal name as it appears on your tax return. If you have a business name, you can enter that as well.

Step 2: Enter Your Business Name (If Applicable)

If you’re completing the W-9 form as a business entity, you’ll need to enter your company’s legal name in this field. If you’re an individual, you can skip this step.

Step 3: Select Your Tax Classification

This is where things can get a bit confusing for some people. The W-9 form asks you to select your tax classification from a list of options. Here’s a quick breakdown of the different options:

- Individual/Sole Proprietor

- C Corporation

- S Corporation

- Partnership

- Trust/Estate

- Limited Liability Company (LLC)

Most independent contractors or freelancers will select “Individual/Sole Proprietor” since they are self-employed and not part of a larger organization. However, if you are operating as a business entity (such as an LLC), you should select the appropriate classification.

Step 4: Enter Your Address

In this field, you’ll need to enter your complete mailing address. This should be the address where you receive mail, not necessarily your physical address (unless those are the same).

Step 5: Enter Your TIN

Now we’re getting to the nitty-gritty. In this field, you’ll need to enter your Taxpayer Identification Number (TIN). This could be your Social Security Number (SSN) or your Employer Identification Number (EIN). If you’re unsure which number to enter, consult with your tax professional.

Step 6: Sign and Date the Form

Alright, we’re almost done! The last field on the W-9 form is for your signature and date. Just sign and date the form, and you’re good to go!

Congratulations, you’ve successfully filled out the IRS Form W-9! Wasn’t that fun?

Why Is the W-9 Form Important?

Now that you’ve got your W-9 form all filled out and ready to go, let’s take a moment to discuss why this little document is so important.

The primary purpose of the W-9 form is to collect information from independent contractors or freelancers that businesses are required to report to the IRS. This information helps the IRS ensure that individuals and businesses are paying their fair share of taxes and are not evading their tax obligations.

But the W-9 form also serves another important purpose. By providing your TIN to businesses, you’re making it easier for them to report your income to the IRS. This means that you don’t have to worry about keeping track of every single payment you receive as an independent contractor or freelancer. Instead, the business you work for will report your income on a 1099 form, which you’ll receive at the end of the year.

Final Thoughts

Well, there you have it folks, all you ever wanted to know (and more!) about the IRS Form W-9. As you can see, it’s not the most exciting form in the world, but it’s a necessary evil if you want to get paid as an independent contractor or freelancer.

So go ahead and print out that W-9 form, fill it out with gusto, and revel in the joy of knowing that you’re doing your part to keep Uncle Sam happy (and off your back)! Happy tax season!