Are you looking for a printable IRS W-9 form for 2021? Look no further! We’ve got you covered with this accessible, fillable PDF version of the form. Simply click on the link below to download and print:

IRS W-9 Form 2021 Printable PDF

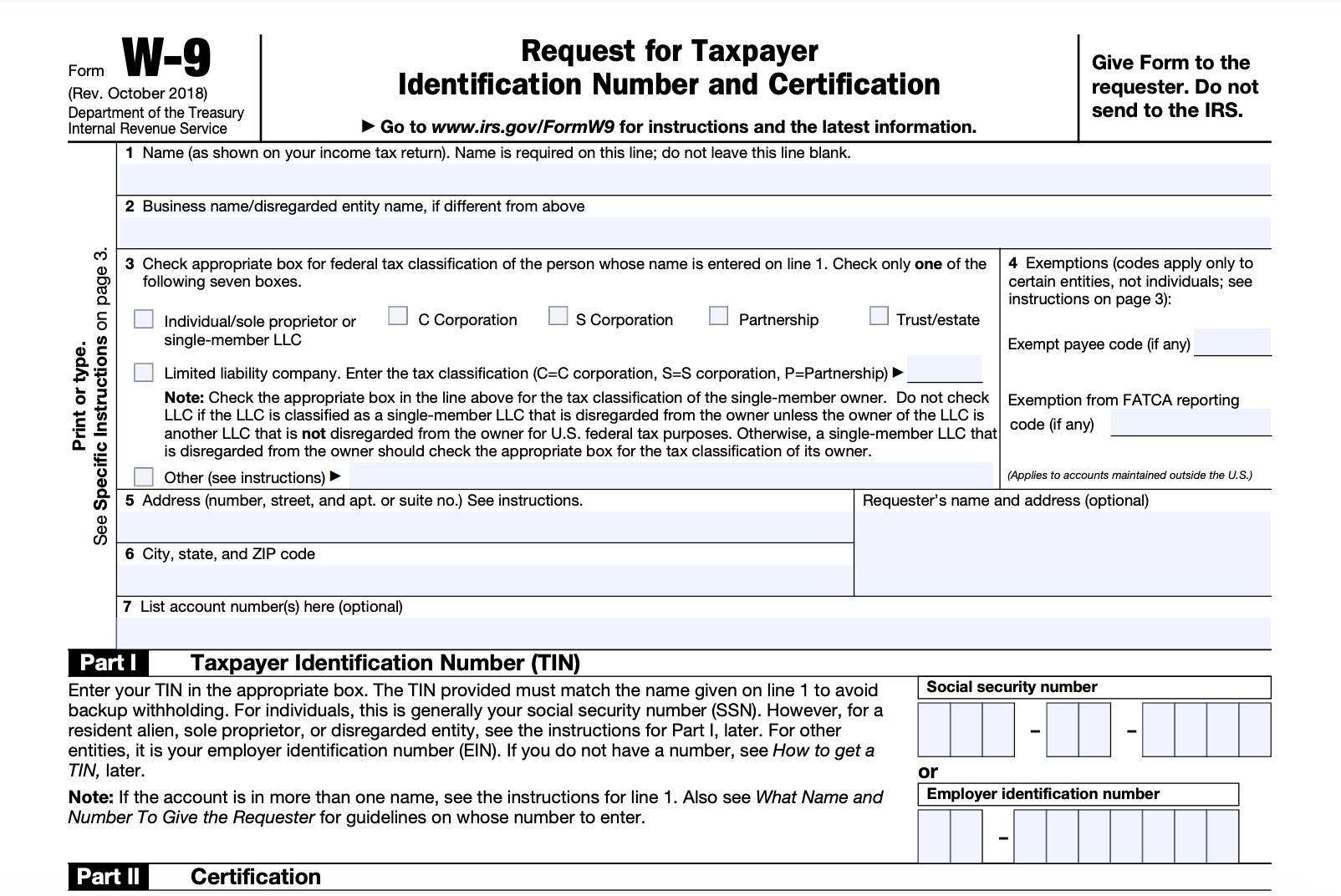

This form is designed for use by independent contractors and other self-employed individuals to report their income to the Internal Revenue Service. By filling out this form, you’ll provide your employer with important information necessary for completing 1099-MISC forms.

This form is designed for use by independent contractors and other self-employed individuals to report their income to the Internal Revenue Service. By filling out this form, you’ll provide your employer with important information necessary for completing 1099-MISC forms.

Remember, it’s important to fill out your W-9 form accurately and completely to avoid any issues later on. Be sure to double-check all information before submitting, and don’t hesitate to ask your employer or a tax professional if you have any questions.

Thanks for checking out our printable IRS W-9 form for 2021! We hope you find it helpful and informative.

IRS W-9 Form Overview

The W-9 form is a crucial component of tax reporting for independent contractors and other self-employed individuals. This form is used to provide your employer with your taxpayer identification number (TIN) and other information necessary for reporting income to the Internal Revenue Service.

If you’re an independent contractor, you’ll need to fill out a W-9 form for each client who pays you more than $600 during the calendar year. Failure to provide accurate information could result in missed payments, penalties, or other issues down the line.

Filling Out Your W-9 Form

The process of filling out your W-9 form is relatively straightforward. Simply enter your name, address, TIN, and other relevant information where indicated on the form.

If you’re a sole proprietor, your TIN will likely be your Social Security number. If you’re a business, your TIN will be your employer identification number (EIN).

Remember, it’s important to provide accurate information on your W-9 form. Double-check all numbers and spellings before submitting, and don’t hesitate to ask for help if you have any questions or concerns.

Submitting Your W-9 Form

Once you’ve completed your W-9 form, you’ll typically need to submit it to your employer or client. Many companies now offer electronic submission options, which can save time and hassle for everyone involved.

Be sure to keep a copy of your completed W-9 form for your records. You may need to refer back to this form at tax time or in future interactions with the IRS or your employer.

Tips for Completing Your W-9 Form

Here are a few things to keep in mind as you fill out your W-9 form:

- Take your time – rushing through the form could result in errors or inaccurate information

- Double-check all numbers and other data before submitting

- Don’t hesitate to ask your employer or a tax professional for help if you have any questions or concerns

- Keep a copy of your completed form for your records

Conclusion

Thanks for checking out our printable IRS W-9 form for 2021. We hope you find this resource helpful as you navigate tax reporting requirements for independent contractors and self-employed individuals.

Remember, submitting accurate and complete information on your W-9 form is crucial for avoiding issues down the line. Take your time, double-check your work, and don’t hesitate to ask for help if you have any questions or concerns.

Good luck with tax reporting and all your other business endeavors!