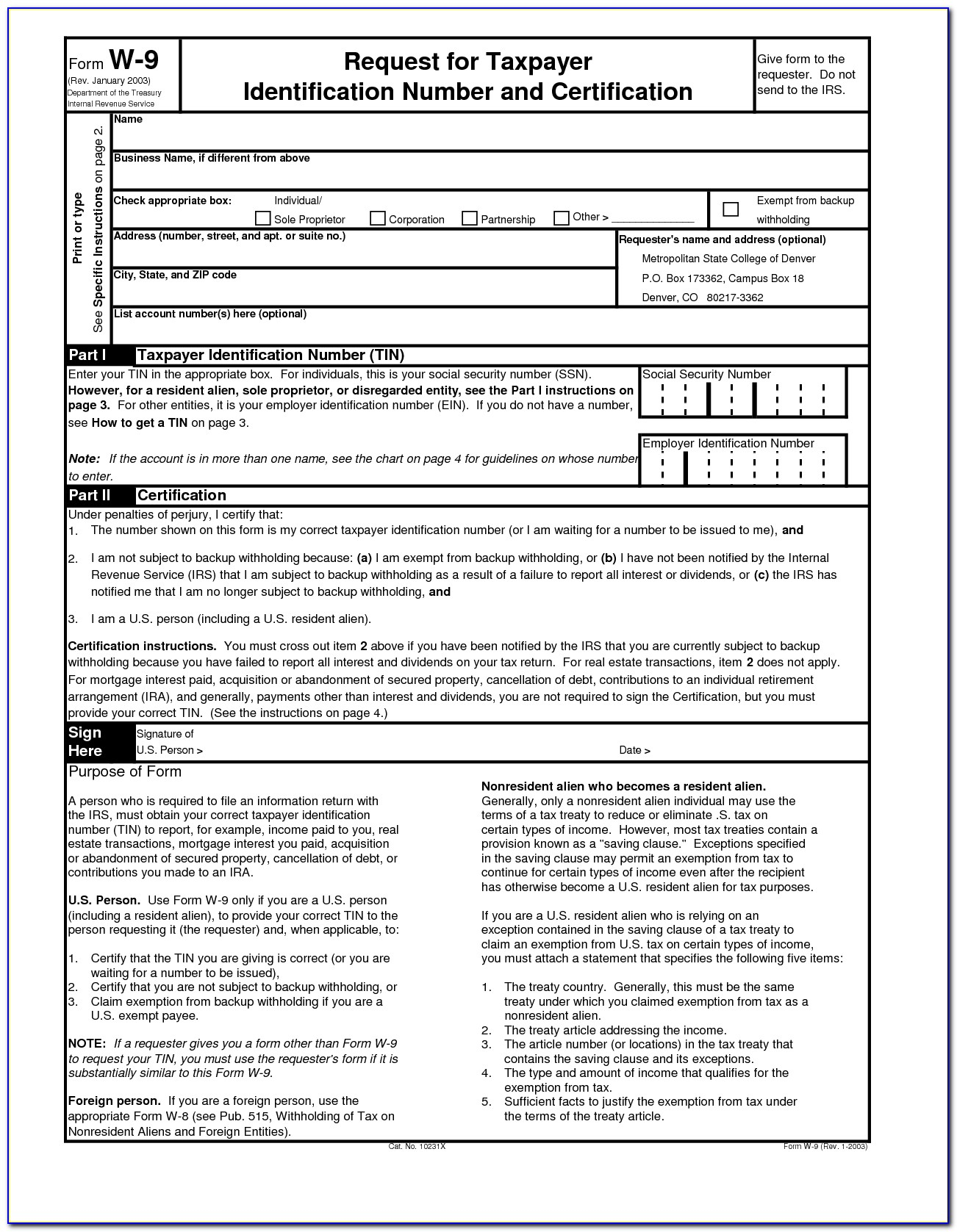

Are you in need of a W-9 form? Look no further than this free printable version that we have found for you. This W-9 form is blank and ready to use. Simply print it out and fill it in with the necessary information.

W-9 Form Basics

The W-9 form is used to collect information from independent contractors or self-employed individuals. This information is then used by businesses to complete Form 1099-MISC which reports income paid to the individual and filed with the IRS.

The W-9 form is used to collect information from independent contractors or self-employed individuals. This information is then used by businesses to complete Form 1099-MISC which reports income paid to the individual and filed with the IRS.

The form requires basic information such as name, address, and taxpayer identification number. It is important to provide accurate information on the W-9 form in order to avoid issues with the IRS in the future.

Why Do You Need a W-9 Form?

If you are an independent contractor or self-employed individual, you will likely be asked to fill out a W-9 form by businesses that you work with. This form provides the information needed for them to file their taxes and ensure that they are in compliance with IRS regulations.

Even if you do not receive a W-9 form from a business that you work with, it is still a good idea to fill one out and provide it to them. This will ensure that the information they have on file for you is accurate and up to date.

How to Fill Out a W-9 Form

When filling out a W-9 form, it is important to provide accurate and complete information. The form has several sections that need to be filled out:

Name

Enter your legal name as it appears on your tax return.

Business Name (if applicable)

If you have a business name, you can enter it in this section. If not, you can leave it blank.

Federal Tax Classification

Check the box that applies to your federal tax classification. This will likely be either sole proprietorship, partnership, LLC, or corporation.

Exemptions

If you are exempt from backup withholding, you can enter your exemption code in this section.

Address

Enter your mailing address in this section.

TIN

Enter your taxpayer identification number. For most people, this will be their social security number.

Signature and Date

Sign and date the form to certify that the information you have provided is accurate.

What Happens After You Fill Out a W-9 Form?

After you fill out a W-9 form, you can expect that the business that requested it will use the information to file Form 1099-MISC. This form reports the income that they paid to you during the year and is filed with the IRS.

It is important to note that if you are paid less than $600 during the year, the business is not required to file Form 1099-MISC. However, you are still required to report the income on your tax return.

Conclusion

If you are an independent contractor or self-employed individual, the W-9 form is an important document to be familiar with. It ensures that the businesses you work with have the necessary information to file their taxes and helps you stay in compliance with IRS regulations. Use this free printable version to easily fill out and provide the necessary information.