It’s that time of year again! Tax season is just around the corner, and if you’re like most Americans, you’ll be receiving a W-2 form from your employer soon. But what exactly is a W-2 form, and what do you need to know about it for the upcoming tax season?

What is a W-2 form?

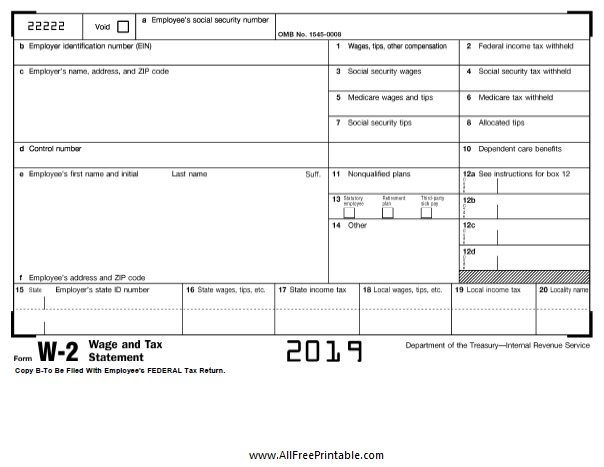

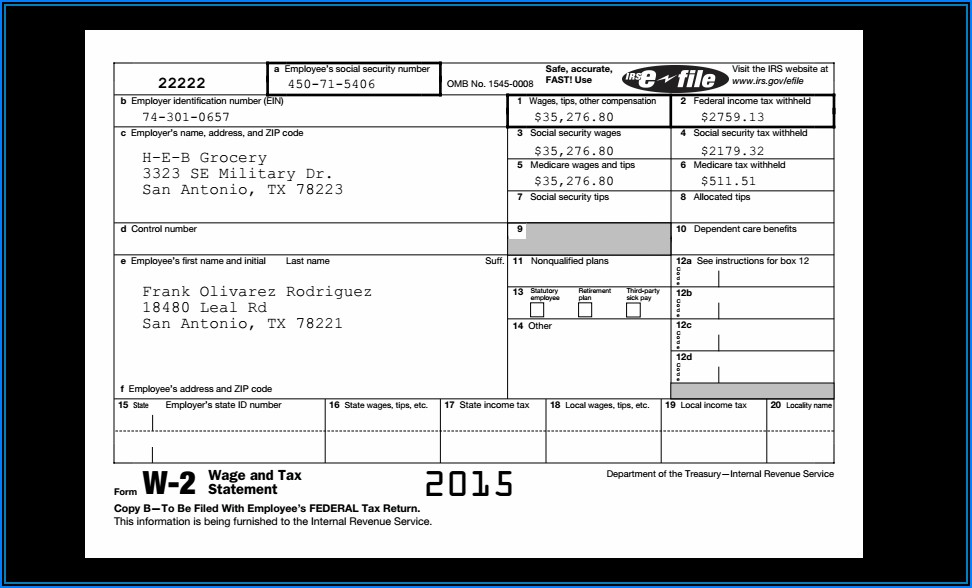

A W-2 form, also known as a Wage and Tax Statement, is a document that your employer is required to provide you with at the end of each calendar year. It reports the total amount of money you earned from your job, as well as the total amount of taxes that were withheld from your paycheck throughout the year.

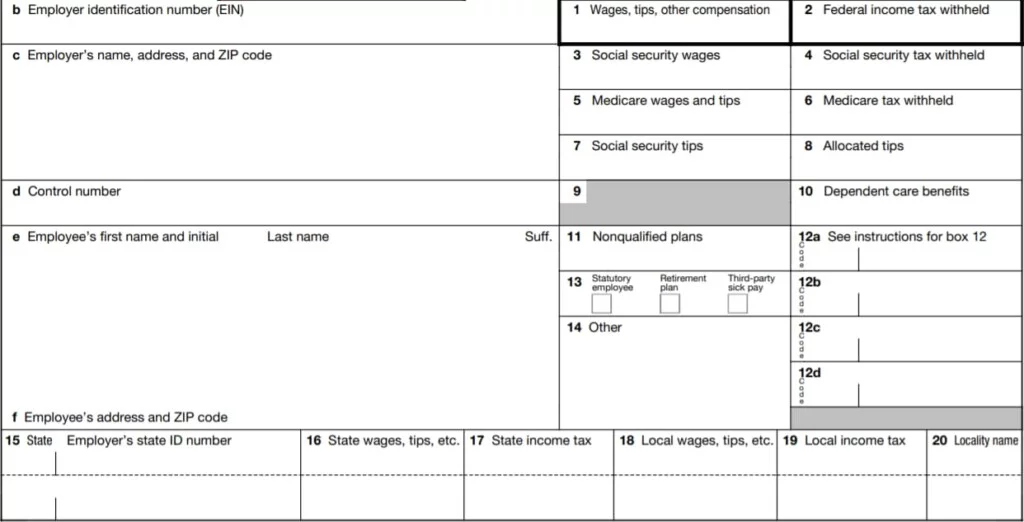

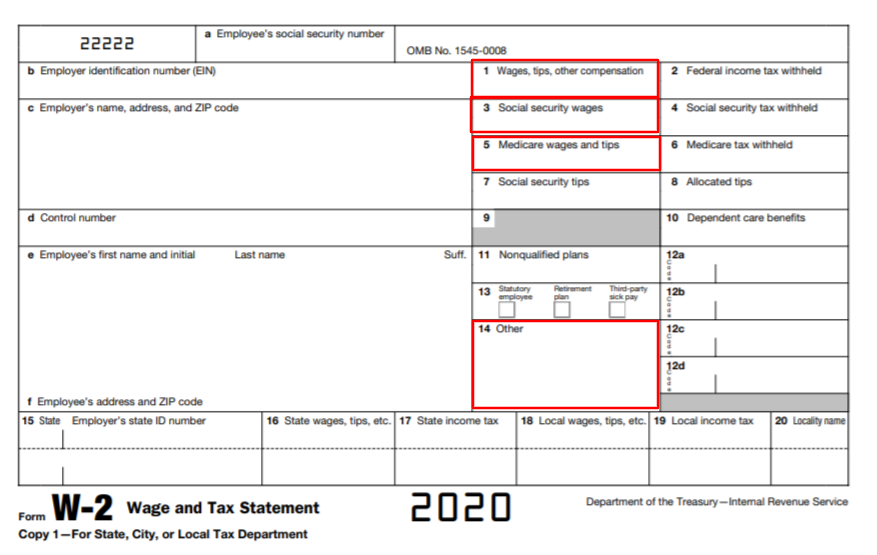

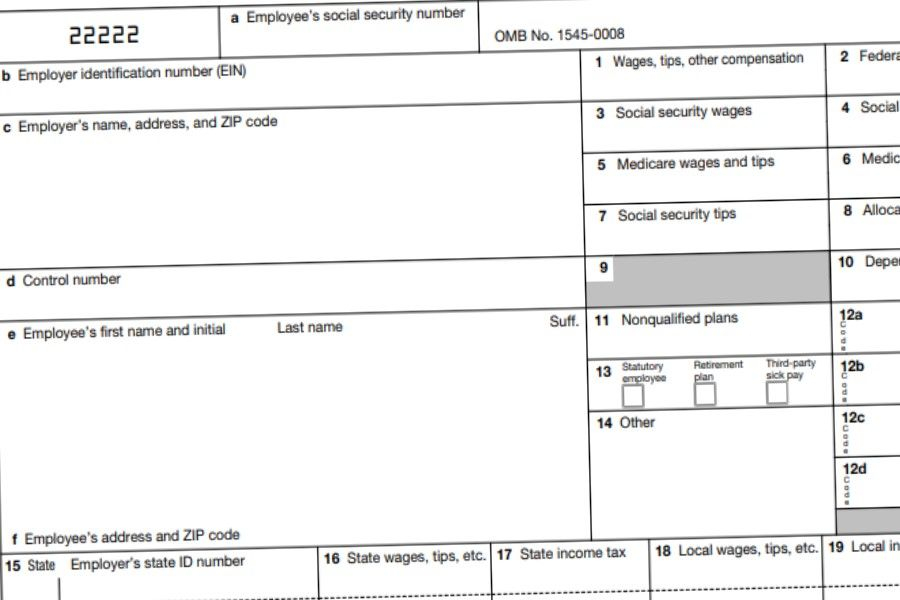

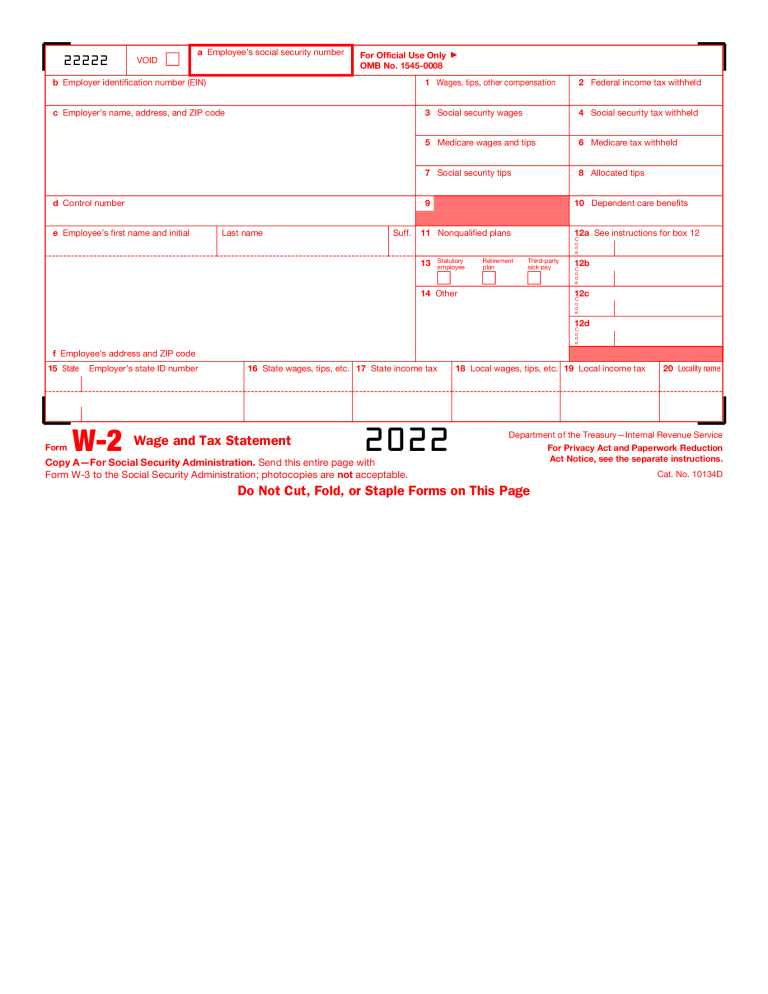

Each W-2 form contains a variety of information, including your name, Social Security number, and address, as well as your employer’s name, address, and Federal Employer Identification Number (FEIN). In addition, the form lists the total wages you earned during the year in Box 1, as well as the amount of federal income tax, Social Security tax, and Medicare tax that was withheld from your paycheck throughout the year.

Each W-2 form contains a variety of information, including your name, Social Security number, and address, as well as your employer’s name, address, and Federal Employer Identification Number (FEIN). In addition, the form lists the total wages you earned during the year in Box 1, as well as the amount of federal income tax, Social Security tax, and Medicare tax that was withheld from your paycheck throughout the year.

Why is a W-2 form important?

A W-2 form is important for a number of reasons. First and foremost, it is used to determine how much income tax you owe for the year. When you file your tax return, you’ll need to report the total amount of wages you earned during the year, as well as the amount of taxes that were withheld from your paycheck. This information is used to calculate your total tax liability for the year.

In addition, a W-2 form is important because it provides a record of your earnings and tax withholding for the year. This information can be useful if you need to apply for a loan or credit card, or if you’re applying for a job and need to provide proof of employment.

What do I need to do with my W-2 form?

What do I need to do with my W-2 form?

When you receive your W-2 form, it’s important to review it carefully to make sure that all of the information is correct. If you notice any errors, such as an incorrect Social Security number or incorrect wage information, you should contact your employer right away to have the form corrected.

Once you’ve reviewed your W-2 form and verified that all of the information is correct, you should keep it in a safe place with your other tax documents. You’ll need the information on your W-2 form in order to file your tax return for the year, so it’s important to keep it in a place where you can easily find it when you need it.

What if I don’t receive a W-2 form?

If you don’t receive a W-2 form from your employer by the end of January, you should contact them to find out when you can expect to receive it. If you still haven’t received your W-2 form by mid-February, you can contact the IRS for assistance.

Can I file my tax return without a W-2 form?

Can I file my tax return without a W-2 form?

No, you cannot file your tax return without a W-2 form. The information on your W-2 form is essential for calculating your total tax liability for the year, so it’s important to have it before you file your tax return.

If you haven’t received your W-2 form by the time you’re ready to file your tax return, you can contact the IRS for assistance. They can help you obtain the information you need to file your tax return, such as your total wages and the amount of taxes that were withheld from your paycheck.

Where can I find more information about W-2 forms?

Where can I find more information about W-2 forms?

If you have additional questions about W-2 forms, you can consult the IRS website for more information. They provide detailed instructions on how to fill out your W-2 form, as well as information on how to file your tax return.

In addition, you can speak to a tax professional for advice and guidance on how to navigate the tax filing process. They can help you identify any deductions or credits that you may qualify for, as well as answer any other questions you may have about your taxes.

Conclusion

A W-2 form is a critical document that you’ll need to have in order to file your tax return for the year. It provides important information about your earnings and tax withholding for the year, and is used to determine how much income tax you owe for the year.

If you receive a W-2 form from your employer, be sure to review it carefully and keep it in a safe place with your other tax documents. If you need help filing your taxes or have questions about your W-2 form, speak to a tax professional for guidance.

Remember, filing your taxes can be a complex and overwhelming process, but with the right information and guidance, you can navigate it successfully and avoid any unnecessary penalties or fees.

Remember, filing your taxes can be a complex and overwhelming process, but with the right information and guidance, you can navigate it successfully and avoid any unnecessary penalties or fees.

About the Author

This content was written by a team of tax professionals at [INSERT COMPANY NAME HERE]. We are dedicated to providing accurate and reliable tax information to help make the tax filing process easier and less stressful for individuals and businesses alike.

Disclaimer: This content is for informational purposes only and should not be construed as legal, tax, or financial advice. Please consult a qualified professional for advice and guidance on your specific situation.

Disclaimer: This content is for informational purposes only and should not be construed as legal, tax, or financial advice. Please consult a qualified professional for advice and guidance on your specific situation.

We hope you found this information helpful and informative. If you have any questions or comments, please feel free to reach out to us at any time. We’re here to help!

We hope you found this information helpful and informative. If you have any questions or comments, please feel free to reach out to us at any time. We’re here to help!