For all our fellow taxpayers out there, we have some important information to share with you. We have collected some valuable resources that will help you navigate through the complicated world of tax season. These resources include printable IRS tax forms, instructions, and guidelines to make your tax season as smooth as possible. We understand how stressful tax season can be, so we are here to help you every step of the way.

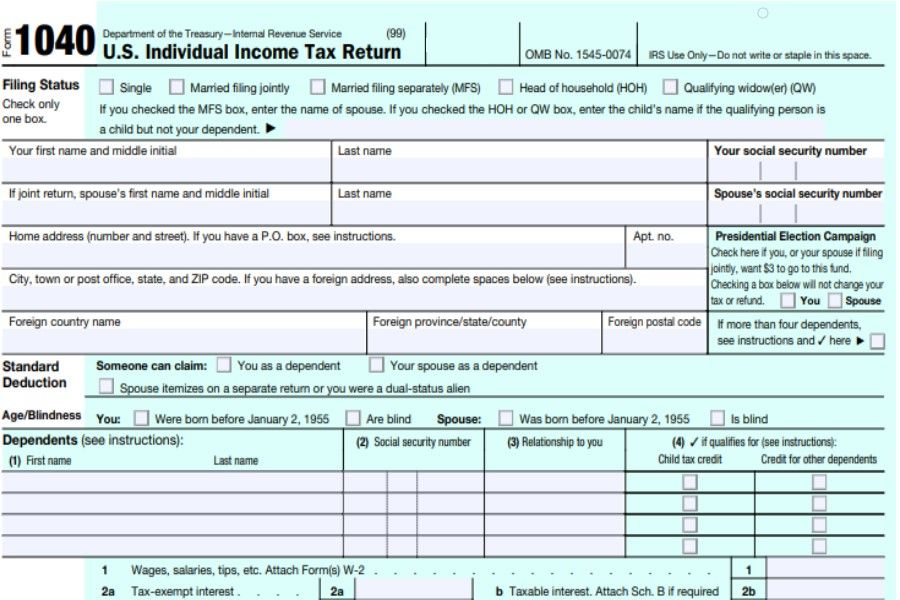

Form 1040 – Page 1

The Form 1040 is probably the most common form used by U.S. taxpayers. It is important to note that there are several versions of this form, depending on your filing status and the credits and deductions you are eligible to claim. This specific form, Form 1040 – Page 1, is used to report your total income and certain adjustments to that income. It is important to fill out this form accurately, as any mistakes could result in penalties and interest charges.

The Form 1040 is probably the most common form used by U.S. taxpayers. It is important to note that there are several versions of this form, depending on your filing status and the credits and deductions you are eligible to claim. This specific form, Form 1040 – Page 1, is used to report your total income and certain adjustments to that income. It is important to fill out this form accurately, as any mistakes could result in penalties and interest charges.

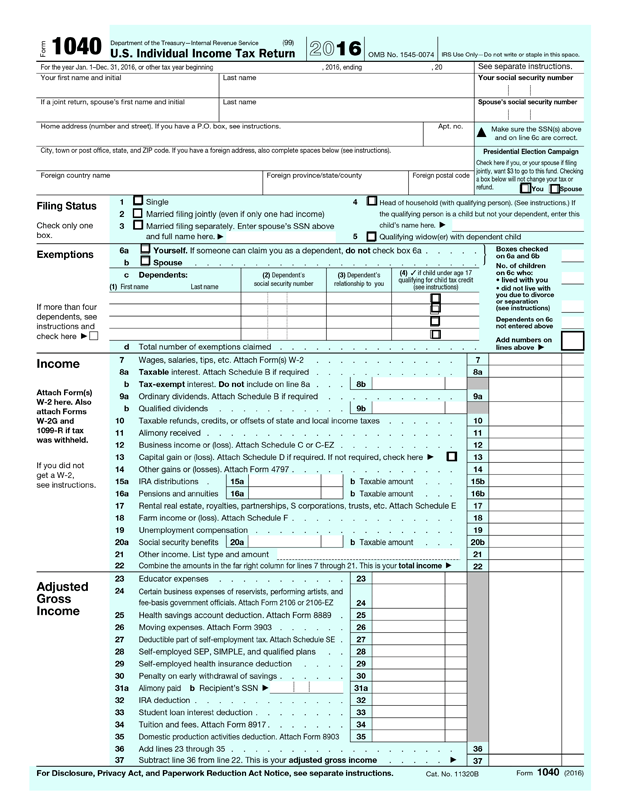

2021 Federal Tax Forms

When it comes to filing your federal tax return, there are a few different forms you may need to complete. The specific forms you need will depend on your unique tax situation. The 2021 Federal Tax Forms are the latest versions of the forms, and they are available for download on the IRS website. These forms include the 1040, 1040-SR, 1040-ES, and many more.

When it comes to filing your federal tax return, there are a few different forms you may need to complete. The specific forms you need will depend on your unique tax situation. The 2021 Federal Tax Forms are the latest versions of the forms, and they are available for download on the IRS website. These forms include the 1040, 1040-SR, 1040-ES, and many more.

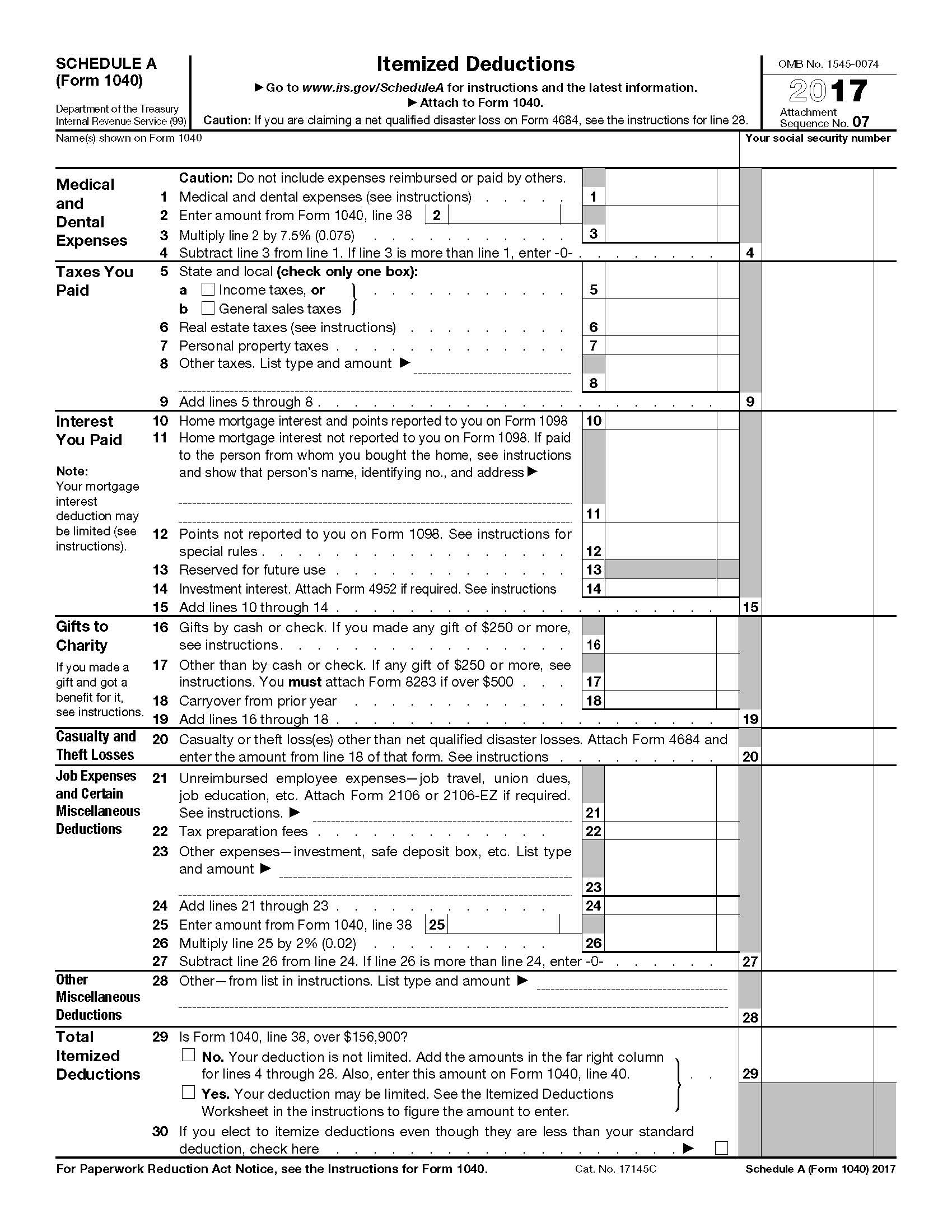

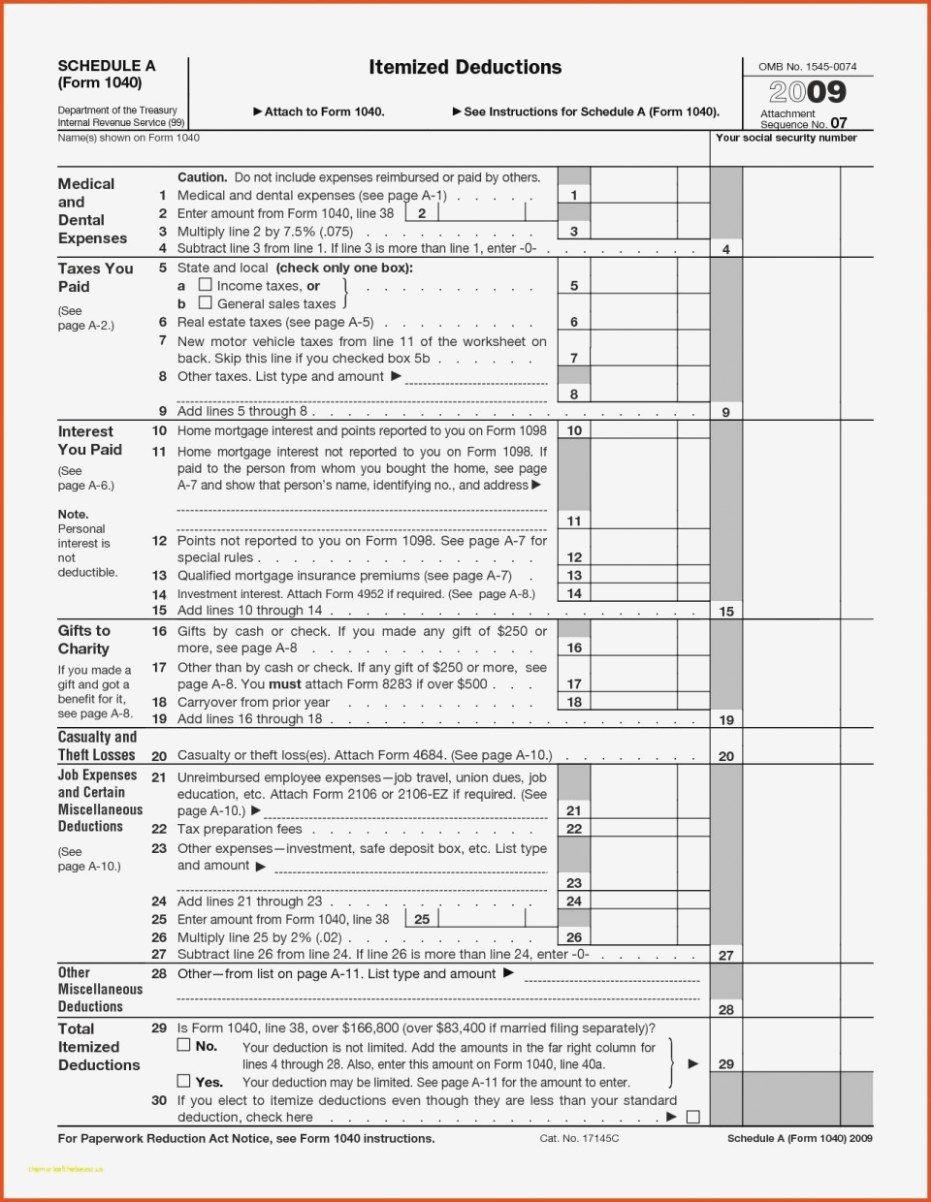

Form 1040 – Schedule A

If you choose to itemize your deductions rather than taking the standard deduction, you will need to use Form 1040 – Schedule A. This form is used to report various types of deductions, including medical expenses, state and local taxes, mortgage interest, charitable contributions, and many more. It is important to keep detailed records of all your deductions throughout the year, so that you are able to accurately complete this form.

If you choose to itemize your deductions rather than taking the standard deduction, you will need to use Form 1040 – Schedule A. This form is used to report various types of deductions, including medical expenses, state and local taxes, mortgage interest, charitable contributions, and many more. It is important to keep detailed records of all your deductions throughout the year, so that you are able to accurately complete this form.

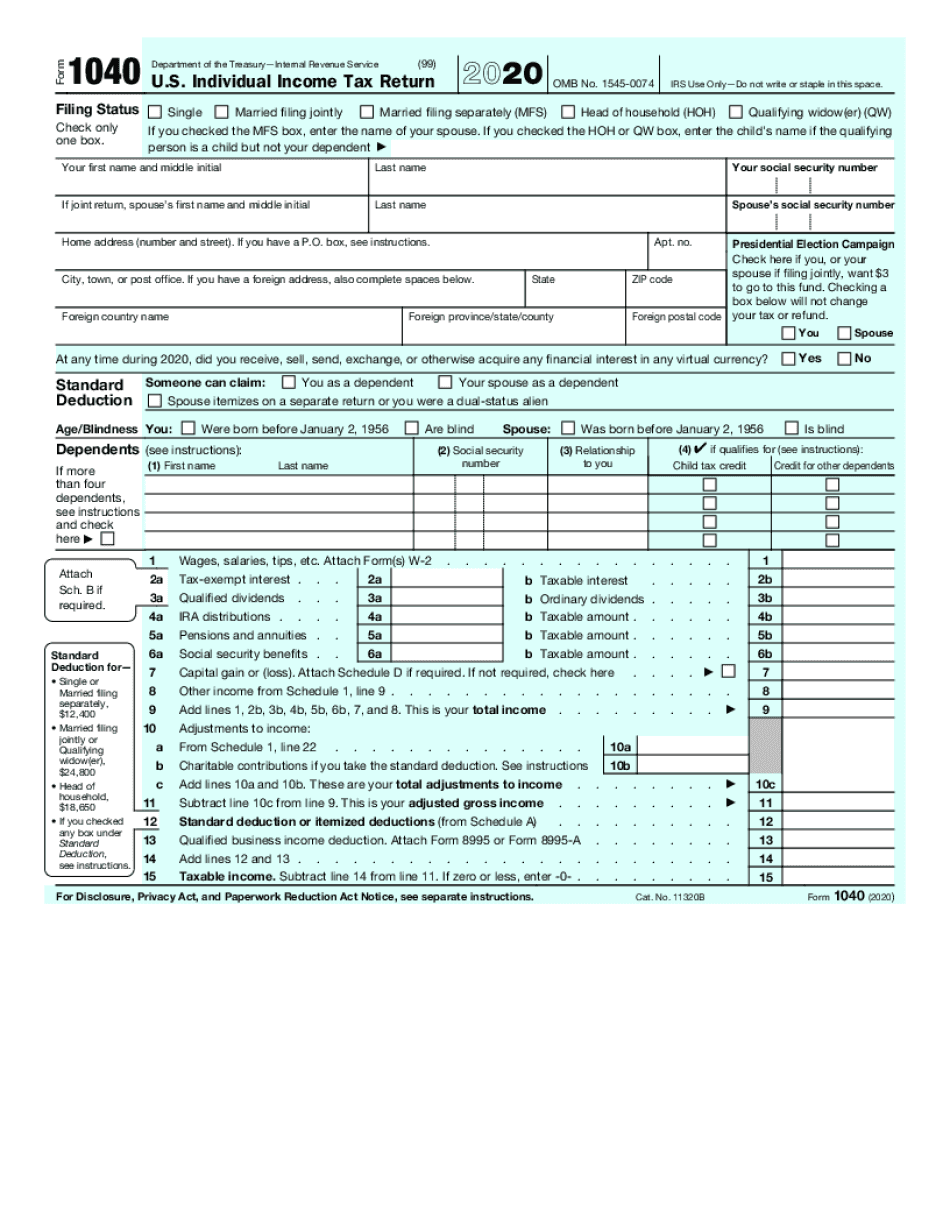

IRS 1040 Form Template

If you prefer to file your taxes online, you can use the IRS 1040 Form Template. This template allows you to create and fill out your tax form online, and then submit it electronically to the IRS. This method of filing is becoming increasingly popular, as it is faster and more convenient than traditional paper filing methods.

If you prefer to file your taxes online, you can use the IRS 1040 Form Template. This template allows you to create and fill out your tax form online, and then submit it electronically to the IRS. This method of filing is becoming increasingly popular, as it is faster and more convenient than traditional paper filing methods.

Form 1040 – Schedule SE

If you are self-employed, you will need to use Form 1040 – Schedule SE to report your self-employment tax. This form determines the amount of Social Security and Medicare taxes you owe on your self-employment income. It is important to accurately report your self-employment income, so that you do not underpay your taxes or face penalties.

If you are self-employed, you will need to use Form 1040 – Schedule SE to report your self-employment tax. This form determines the amount of Social Security and Medicare taxes you owe on your self-employment income. It is important to accurately report your self-employment income, so that you do not underpay your taxes or face penalties.

IRS Tax Forms – Printable IRS Form

If you prefer to fill out your tax forms in paper form, you can easily find printable IRS tax forms online. You can find all the necessary forms for filing your federal tax return, as well as any necessary state tax forms. These printable forms are easy to download and print, so you can fill them out at your convenience.

If you prefer to fill out your tax forms in paper form, you can easily find printable IRS tax forms online. You can find all the necessary forms for filing your federal tax return, as well as any necessary state tax forms. These printable forms are easy to download and print, so you can fill them out at your convenience.

Free Printable IRS 1040 Forms

If you are on a tight budget, you may be interested in free printable IRS 1040 forms. These forms are available online for free, and you can easily download and print them from your computer. You will still need to fill out the forms accurately and completely, but you can save money by printing them yourself rather than purchasing them from a tax preparer.

If you are on a tight budget, you may be interested in free printable IRS 1040 forms. These forms are available online for free, and you can easily download and print them from your computer. You will still need to fill out the forms accurately and completely, but you can save money by printing them yourself rather than purchasing them from a tax preparer.

Form IL-1040-X – Amended Individual Income Tax Return

If you discover an error on your tax return after you have already filed it, you may need to file an amended tax return using Form IL-1040-X. This form allows you to make changes to your original tax return and correct any errors or omissions. It is important to file this form as soon as possible after you discover the error, as there may be penalties and interest charges for late or incorrect filings.

If you discover an error on your tax return after you have already filed it, you may need to file an amended tax return using Form IL-1040-X. This form allows you to make changes to your original tax return and correct any errors or omissions. It is important to file this form as soon as possible after you discover the error, as there may be penalties and interest charges for late or incorrect filings.

Printable Tax Forms 1040ez 2018

If you have a simple tax situation and do not have a lot of deductions or credits to claim, you may be eligible to use the Printable Tax Forms 1040ez 2018. This form is designed for those who have a relatively low income and do not have a lot of complex tax issues or deductions to claim. It is important to read the instructions carefully and make sure you are eligible to use this form before filing your tax return.

If you have a simple tax situation and do not have a lot of deductions or credits to claim, you may be eligible to use the Printable Tax Forms 1040ez 2018. This form is designed for those who have a relatively low income and do not have a lot of complex tax issues or deductions to claim. It is important to read the instructions carefully and make sure you are eligible to use this form before filing your tax return.

We hope that these resources will be helpful to you during tax season. Remember, it is important to accurately report your income and deductions, so that you do not face penalties or interest charges later on. If you have any questions or concerns about your tax return, it is always best to consult with a qualified tax professional or the IRS directly. Best of luck this tax season!