One of the most crucial aspects of any property transaction is the process of title search and ownership verification. In real estate, the legal concept of a lien is essential to protect the claim of the creditor against the debtor’s property. A lien is a legal claim on a debtor’s property that secures the repayment of a debt. In simple terms, it’s a guarantee that the property cannot be sold or transferred until the debt is cleared. A property lien form is a legal document that helps in claiming a lien on a property.

The Purpose of Property Lien Forms

Property lien forms are used for a variety of reasons, including:

- Securing a loan by using property as collateral

- Enforcing a judgment by securing a lien on a property owned by the debtor

- Protecting the interests of contractors, subcontractors, and material suppliers in the construction industry

- Protecting the interests of landlords

When a lien is placed on a property, it serves as a legal guarantee that the debtor will satisfy the debt. In case the debtor fails to pay the debt, the creditor can legally foreclose on the property and recover their money. In the case of contractors, subcontractors, and material suppliers, filing a lien can help in recovering unpaid invoices for their services or materials used in the construction of a property.

Types of Property Liens

There are several different types of property liens, and each has its own set of rules and regulations. Some common types of property liens include:

- Mortgage lien: A mortgage lien is a type of lien that is used to secure a mortgage loan. The mortgage lien is recorded in the county land records, and it serves as a legal guarantee that the lender will be paid back the loan amount plus interest.

- Consumer lien: Consumer liens are created when a consumer borrows money or uses a credit card to purchase goods or services. The lien secures the creditor’s interest in the goods or services purchased by the consumer.

- Judgment lien: A judgment lien is a lien that is created when a court orders a debtor to pay a certain amount of money to the creditor. If the debtor fails to pay the judgment, the creditor can place a lien on the debtor’s property.

- Property tax lien: A property tax lien is a lien that is placed on a property owner’s property when they fail to pay their property taxes. The lien ensures that the county will receive payment for the unpaid taxes.

How to Fill a Property Lien Form

If you need to create a property lien form, there are several steps that you need to follow.

- Determine the type of lien you need to file: The first step in creating a property lien form is to determine the type of lien you need to file. Once you have determined the type of lien you need to file, you can proceed with the next steps.

- Gather the required information: The next step is to gather all the relevant information that you will need to fill out the property lien form. This may include information about the debtor, the creditor, and the property being liened.

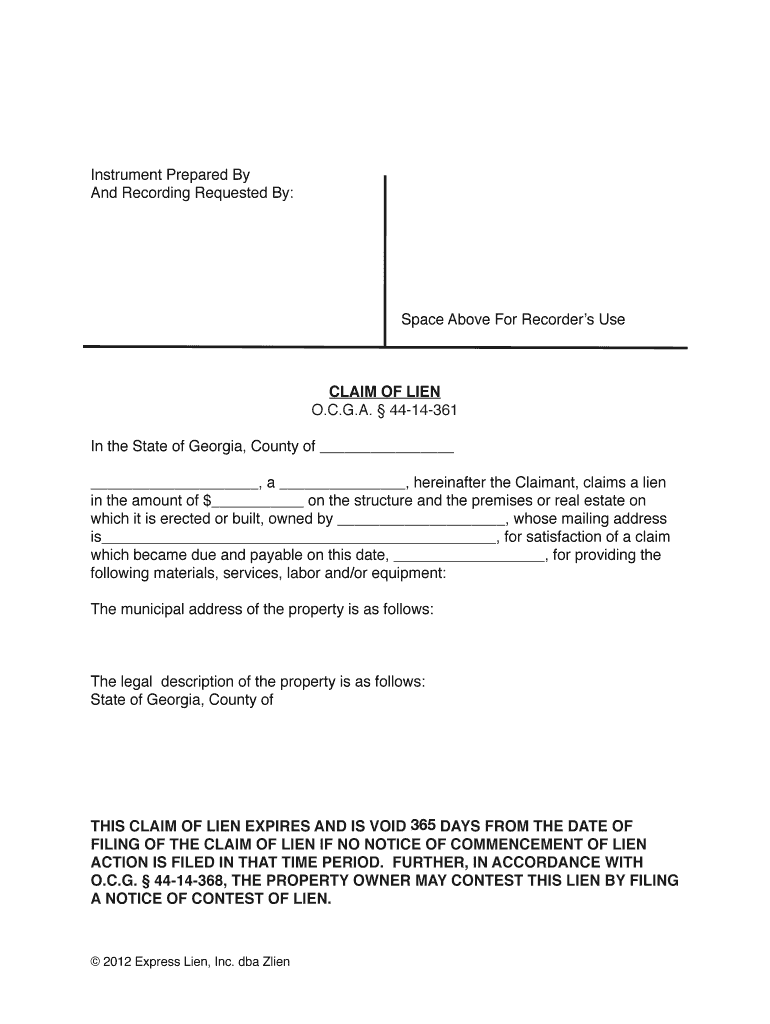

- Obtain the appropriate form: The next step is to obtain the appropriate property lien form for your specific state or county. Your local courthouse or county recorder’s office should have the necessary forms.

- Fill out the form completely: Once you have obtained the appropriate property lien form, you should fill it out completely. Be sure to provide all the necessary information, including the debtor’s name, the creditor’s name, the address of the property, and the amount of the lien.

- File the form: The final step is to file the property lien form with the appropriate county or state office. You may also need to pay a filing fee.

The Benefits of Filing a Property Lien Form

Filing a property lien form can provide several benefits, including:

- Protection: Filing a property lien form can protect the interests of contractors, subcontractors, and material suppliers from non-payment for their services or materials used in the construction of a property.

- Legal guarantee: A lien serves as a legal guarantee that the creditor will be paid back the debt owed to them.

- Enforcement: If the debtor fails to pay the debt, the creditor can legally foreclose on the property and recover their money.

Conclusion

Filing a property lien form is an important legal process that is used to protect the interests of creditors. It ensures that the creditor will be paid back the debt owed to them. By understanding the types of property liens and following the necessary steps to fill out and file the appropriate property lien form, creditors can ensure that their interests are protected in the event of non-payment by the debtor.

If you need to file a property lien form, consider seeking legal counsel to ensure that all necessary steps are followed and that the lien is properly recorded. With the help of an experienced attorney, you can ensure that your interests are protected and that you receive the payment owed to you.

If you need to file a property lien form, consider seeking legal counsel to ensure that all necessary steps are followed and that the lien is properly recorded. With the help of an experienced attorney, you can ensure that your interests are protected and that you receive the payment owed to you.