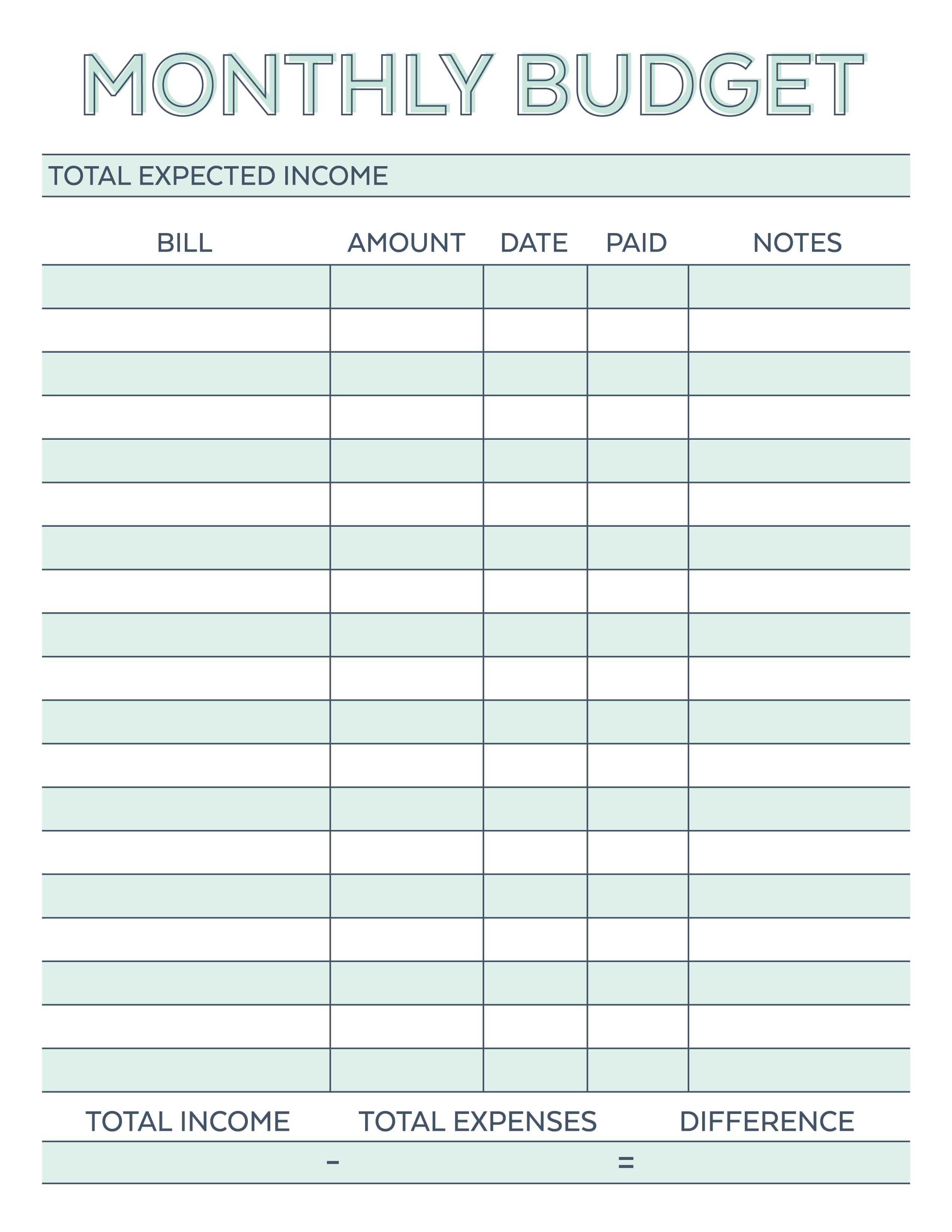

Creating a budget can be a daunting task, but it doesn’t have to be! With our monthly budget planner, we’ve made it easy for you to take control of your finances and achieve your financial goals. First, let’s take a look at the free printable budget worksheet. As you can see from the image below, it’s a well-organized and easy-to-use tool.

Monthly Budget Planner

With our monthly budget planner, you can easily keep track of your income and expenses. This worksheet includes sections for your income, fixed expenses (such as rent or mortgage payments), variable expenses (such as groceries or entertainment), and savings goals.

With our monthly budget planner, you can easily keep track of your income and expenses. This worksheet includes sections for your income, fixed expenses (such as rent or mortgage payments), variable expenses (such as groceries or entertainment), and savings goals.

To start using the worksheet, simply fill in the blanks with your estimated or actual amounts. You can then compare your total income to your total expenses and see if you have any money left over. If not, you may need to adjust your spending or find ways to increase your income.

How to Use the Monthly Budget Planner

To get the most out of the monthly budget planner, we recommend following these steps:

To get the most out of the monthly budget planner, we recommend following these steps:

- Gather your financial information: Before you start using the worksheet, make sure you have all of your financial information in one place. This includes your pay stubs, bills, bank statements, and any other relevant documents.

- Fill in your income: In the “Income” section of the worksheet, fill in your take-home pay (after taxes and deductions). If you have multiple sources of income, such as a side job or freelance work, include those as well.

- List your fixed expenses: In the “Fixed Expenses” section, list all of your bills that stay the same each month, such as rent or mortgage payments, insurance, and subscriptions.

- Record your variable expenses: In the “Variable Expenses” section, list all of your expenses that vary from month to month, such as groceries, transportation, and entertainment. Try to be as accurate as possible with your estimates.

- Set your savings goals: In the “Savings Goals” section, write down any financial goals you have, such as building an emergency fund, paying off debt, or saving for a big purchase. Set a specific amount and timeline for each goal.

- Compare your income to your expenses: Add up your total income and total expenses, and subtract the latter from the former. If you have a positive number, that means you have money left over to put towards your savings goals or other expenses. If you have a negative number, you may need to adjust your spending or find ways to increase your income.

- Review and update regularly: Review your budget on a regular basis, such as once a month, to see if you’re on track to meet your goals. Update it as needed based on any changes in your income or expenses.

Tips for Creating a Successful Budget

To make the most of your monthly budget planner, here are some tips to keep in mind:

To make the most of your monthly budget planner, here are some tips to keep in mind:

- Be realistic: When estimating your expenses, be realistic about how much you’ll spend each month. Don’t forget to include occasional or unexpected expenses, such as car repairs or medical bills.

- Track your spending: Keep track of your actual expenses throughout the month to see how well you’re sticking to your budget. You can use a budgeting app or simply write them down in a notebook.

- Find ways to save: Look for ways to cut back on your expenses, such as cooking at home instead of eating out, using coupons or discount codes, or negotiating bills.

- Automate your savings: Set up automatic transfers from your checking account to your savings account each month to make it easier to reach your savings goals.

- Be flexible: Your budget should be flexible enough to accommodate changes in your life, such as a job loss or unexpected medical expenses. Don’t be afraid to adjust your budget as needed.

With the help of our monthly budget planner, you can take control of your finances and achieve your financial goals. Happy budgeting!