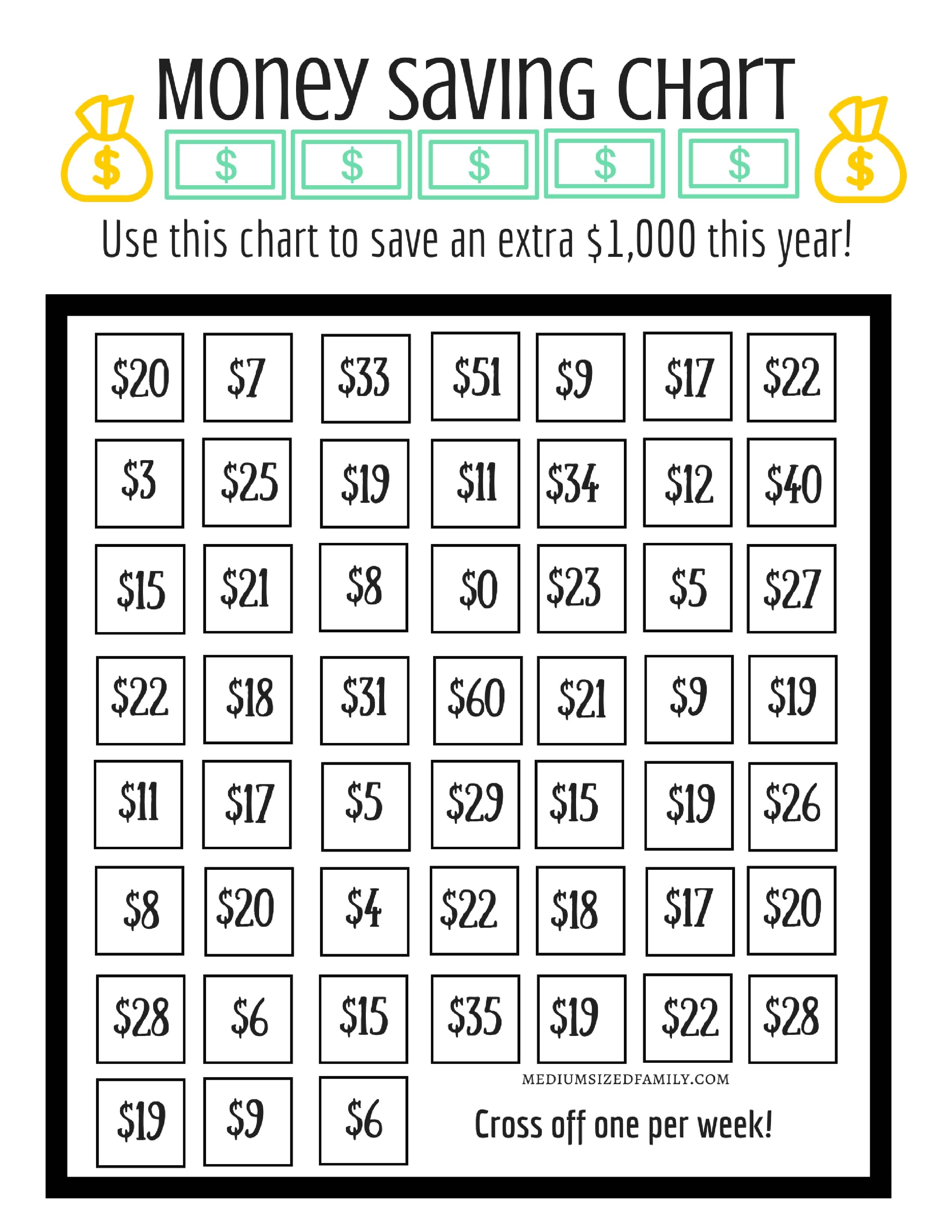

Are you tired of struggling to save your hard-earned money? Well, we have a solution for you! Introducing the 52 Week Money Challenge that will save you $1000 in just one year. This challenge is easy, customizable to fit your budget, and fun to do with friends and family. Starting with just $1 in the first week and increasing by $1 every week, you will have saved a total of $1,378 by the end of the challenge. This chart lays out exactly how much you need to save each week, and with a little discipline, you’ll have an extra $1000 in your pocket at the end of the year.

How it Works

The concept is simple. Each week, you save an amount of money equal to the number of that week. For example, in the first week, you save $1, in the second week, you save $2, in the third week, you save $3, and so on. By week 52, you will have saved $52, bringing your total savings to $1,378.

The concept is simple. Each week, you save an amount of money equal to the number of that week. For example, in the first week, you save $1, in the second week, you save $2, in the third week, you save $3, and so on. By week 52, you will have saved $52, bringing your total savings to $1,378.

But what if you don’t have extra money to save each week? The beauty of this challenge is that you can customize it to fit your budget. Instead of starting with $1 in week one, start with $0.50 or even $0.25. Alternatively, you can save in reverse order, starting with $52 in week one and decreasing by $1 each week. The possibilities are endless.

The Benefits of the 52 Week Money Challenge

Not only will the 52 Week Money Challenge help you save money, but it also has several other benefits.

Not only will the 52 Week Money Challenge help you save money, but it also has several other benefits.

First, it teaches discipline. Saving money is not always easy, but by committing to this challenge, you’ll be forming a habit of setting aside money each week.

Second, it’s a great way to involve friends and family in your financial goals. You can create a group challenge with coworkers, friends, or family members, or even take to social media to find others who are participating in the challenge. This will keep you accountable and motivated to stay on track.

Third, it’s a simple and effective way to jump-start your savings goals. If you’re struggling to save money or don’t know where to start, the 52 Week Money Challenge is a great way to get started.

How to Maximize Your Savings

While the 52 Week Money Challenge is a great way to save money, there are a few additional steps you can take to maximize your savings potential.

While the 52 Week Money Challenge is a great way to save money, there are a few additional steps you can take to maximize your savings potential.

First, automate your savings. Set up a recurring transfer from your checking account to your savings account each week. This will ensure that you don’t forget to save or accidentally spend the money you earmarked for savings.

Second, increase your savings rate over time. After completing the 52 Week Money Challenge, you can continue to save additional amounts each week. For example, instead of just saving $1 in week one, you could save $10 or even $20. This will help you reach your long-term savings goals even faster.

Finally, look for ways to reduce your expenses and increase your income. Cutting back on unnecessary expenses, such as eating out or subscription services, can free up additional money to put towards your savings goals. Additionally, starting a side hustle or finding ways to earn extra income can help you save even more money each week.

Join the Challenge Today

Are you ready to take control of your finances and start saving more money? Join the 52 Week Money Challenge today and see just how much you can save in one year.

Are you ready to take control of your finances and start saving more money? Join the 52 Week Money Challenge today and see just how much you can save in one year.

Remember, the challenge is customizable and can be adapted to fit your budget. Invite friends and family to join you and make it a group effort. And most importantly, stay disciplined and committed to reaching your savings goals.

Are you up for the challenge? Let us know in the comments below!

In conclusion, the 52 Week Money Challenge is a simple and effective way to jump-start your savings goals. By committing to save a little bit each week, you’ll be forming a habit of setting aside money and working towards your long-term financial goals. So why not join the challenge today and see just how much you can save in one year?