Considering the current economic landscape, it’s not uncommon to find individuals or businesses seeking financial assistance. However, you should always approach these agreements with caution, regardless of whether you’re the lender or borrower.

Free Loan Agreement Templates

Thanks to Template Lab, a collection of over 40 free loan agreement templates are available to help you achieve a binding financial agreement with any party. Although it may seem like a hassle, creating a proper agreement can make a difference when it comes to protecting your finances and avoiding legal disputes.

Thanks to Template Lab, a collection of over 40 free loan agreement templates are available to help you achieve a binding financial agreement with any party. Although it may seem like a hassle, creating a proper agreement can make a difference when it comes to protecting your finances and avoiding legal disputes.

When creating your agreement, it’s important to consider and outline the following:

- Amount borrowed

- Interest rate and frequency of payments

- Repayment period

- Collateral (if required)

- Default terms and conditions

By ensuring that these factors are included and clearly outlined, you’ll have a better chance of avoiding any confusion or disagreement in the future.

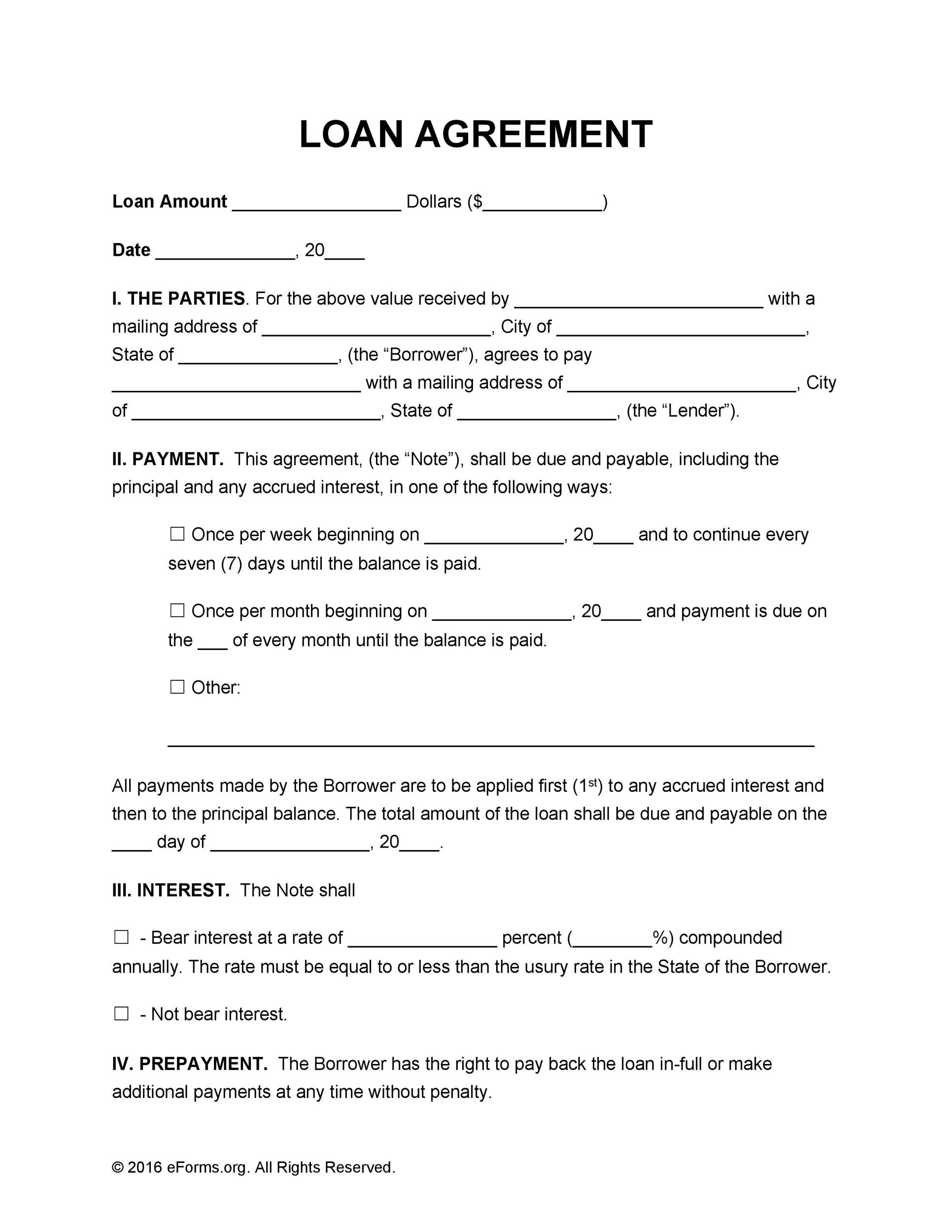

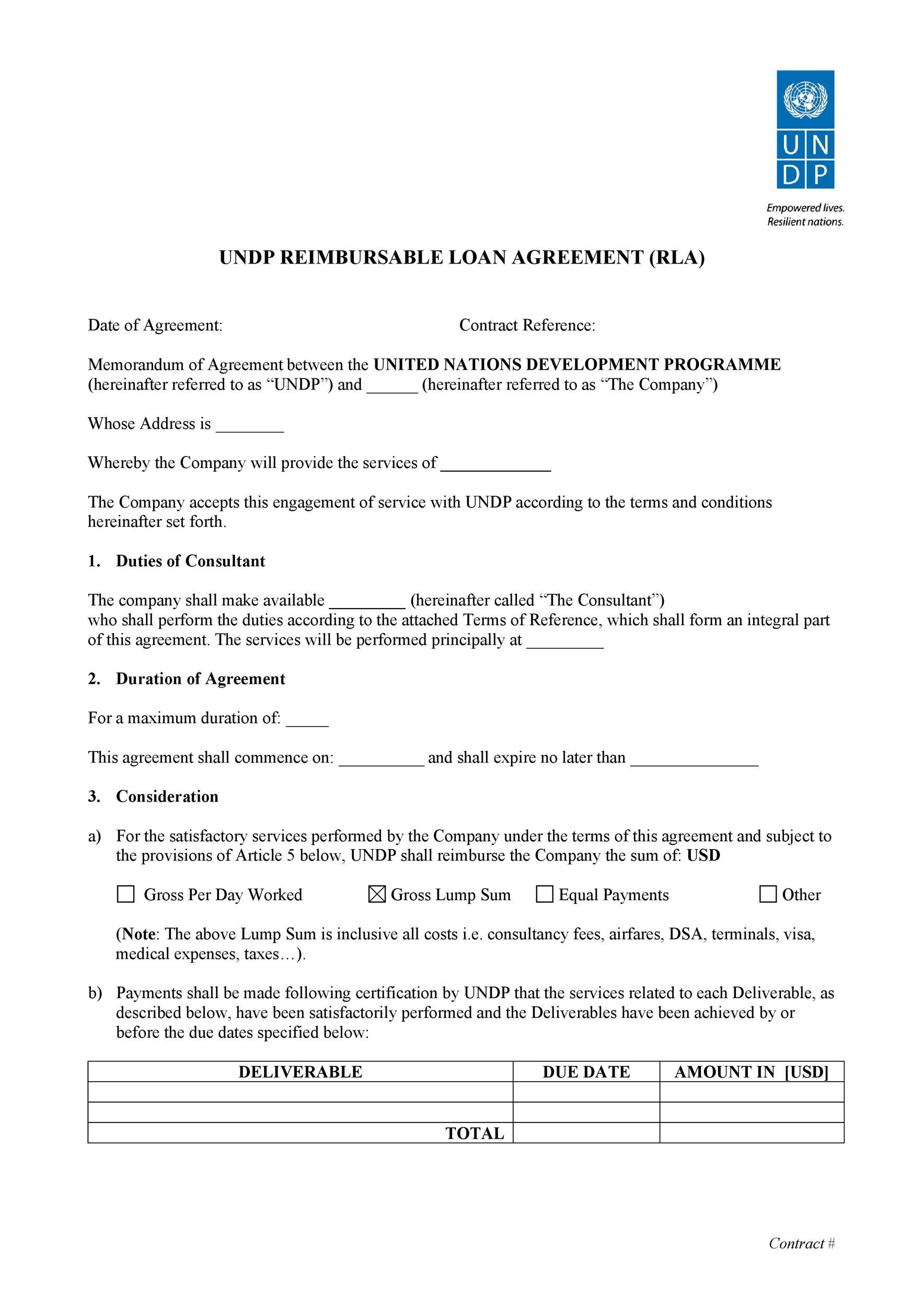

Sample Loan Agreement Template

There are various sample loan agreement templates available on Template Lab’s website. Here is an example of what such an agreement can look like:

There are various sample loan agreement templates available on Template Lab’s website. Here is an example of what such an agreement can look like:

This Loan Agreement (the “Agreement”) is made and entered into on the Effective Date (as defined below) by and between the parties as follows:

LENDER

Name: [insert name of Lender]

Address: [insert address of Lender]

BORROWER

Name: [insert name of Borrower]

Address: [insert address of Borrower]

Effective Date: [Insert effective date here]

1. Loan Amount. Lender has agreed to loan Borrower the sum of [insert loan amount] (“Loan Amount”).

2. Interest Rate. Borrower shall pay interest on the unpaid principal balance of the Loan Amount at a rate of [insert interest rate]% per annum. Interest shall be calculated on the basis of a 365-day year and the actual number of days elapsed.

3. Repayment of Loan. Repayment of the Loan Amount and all accrued and unpaid interest shall be made by Borrower to Lender in [insert number of installments] consecutive installments of [insert amount per installment payment].

4. Default. If Borrower fails to make any payment when due under this Agreement or otherwise breaches any covenant, condition or agreement contained in this Agreement, Lender shall have the right to declare this Agreement in default and immediately demand payment in full of all amounts then owed by Borrower to Lender.

5. Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of [insert applicable state], without giving effect to the principles of conflicts of law thereof.

6. Entire Agreement. This Agreement constitutes the entire agreement between the parties and supersedes all prior understandings and agreements, both written and oral, between the parties with respect to the Loan Amount.

7. Amendment and Waiver. This Agreement may not be amended or waived except by a writing executed by both parties.

This Loan Agreement is executed by the parties as of the Effective Date first above written.

Lender:

_______________________________

Name: [insert name of Lender]

By:

Title:

Borrower:

_______________________________

Name: [insert name of Borrower]

By:

Title:

Conclusion

When it comes to financial agreements, transparency and clear communication are key. Utilizing a loan agreement template is a simple way to protect yourself, your business, or your personal finances. By taking the time to create a clear and concise agreement, you’ll be able to avoid potential legal disputes and make sound financial decisions.

When it comes to financial agreements, transparency and clear communication are key. Utilizing a loan agreement template is a simple way to protect yourself, your business, or your personal finances. By taking the time to create a clear and concise agreement, you’ll be able to avoid potential legal disputes and make sound financial decisions.