OMG, folks! Let’s talk about the almighty dollar, or five-dollar bill, to be exact! Money is such a serious matter, but that doesn’t mean we can’t have a little fun while we’re saving up for a rainy day!

The 5 Dollar Bill Challenge

Have you heard of the 5 Dollar Bill Challenge? In case you haven’t, let me break it down for you. Every time you come across a 5 dollar bill, you keep it and don’t spend it. Easy, right? But wait, there’s more. The goal is to keep doing this until you’ve saved up $1,000 or more by the end of the year!

Have you heard of the 5 Dollar Bill Challenge? In case you haven’t, let me break it down for you. Every time you come across a 5 dollar bill, you keep it and don’t spend it. Easy, right? But wait, there’s more. The goal is to keep doing this until you’ve saved up $1,000 or more by the end of the year!

The Benefits

Not only does this challenge help you save money, but it also helps you develop discipline and awareness of your spending habits. You’ll start to notice all the times you would’ve spent that 5 dollar bill on something unnecessary if you weren’t keeping it for the challenge. Plus, at the end of the year, you’ll have a nice chunk of cash that you can put towards paying off debt, a down payment on a car or house, or even a dream vacation!

Not only does this challenge help you save money, but it also helps you develop discipline and awareness of your spending habits. You’ll start to notice all the times you would’ve spent that 5 dollar bill on something unnecessary if you weren’t keeping it for the challenge. Plus, at the end of the year, you’ll have a nice chunk of cash that you can put towards paying off debt, a down payment on a car or house, or even a dream vacation!

The Printables

Now, of course, we wouldn’t leave you hanging without some helpful printables to keep track of your progress. There are a ton of free printables available online that you can download and print out, like the one above. You can also find some for sale on Etsy that have more creative designs and layouts.

Here’s another adorable printable from Etsy, perfect for those who love a good floral design. Just imagine those pretty blooms as you’re saving up for your next big purchase!

Here’s another adorable printable from Etsy, perfect for those who love a good floral design. Just imagine those pretty blooms as you’re saving up for your next big purchase!

The Fun Factor

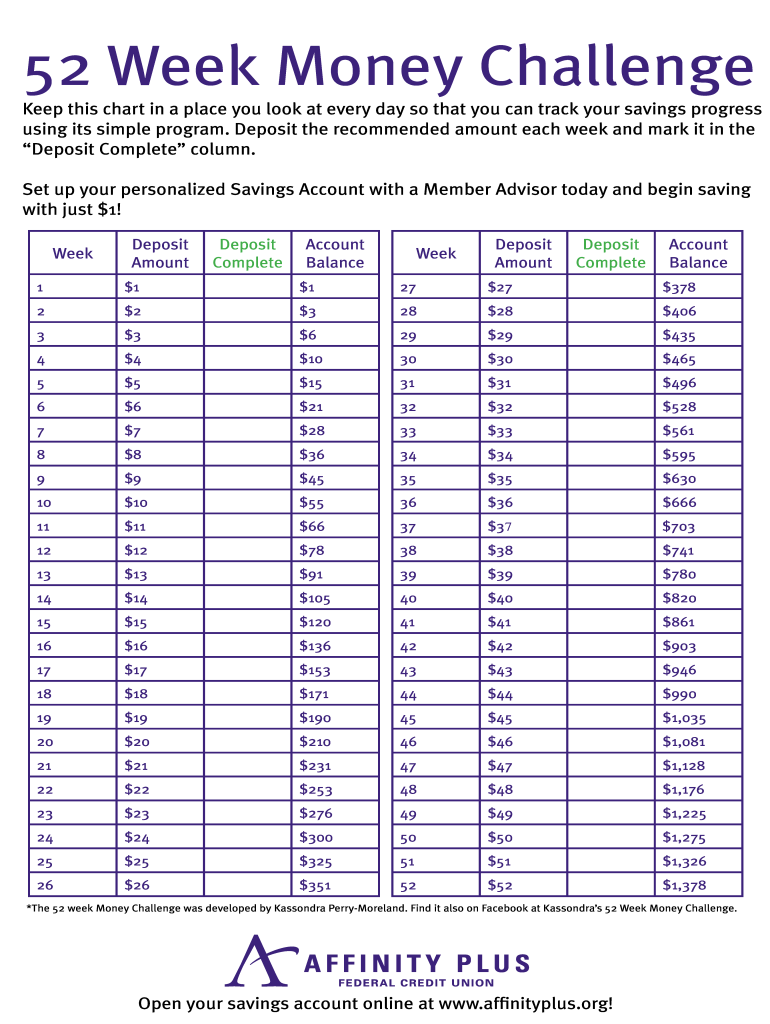

If the 5 Dollar Bill Challenge isn’t enough for you, why not try the 52 Week Money Challenge? The concept is simple: You save a certain amount of money each week for 52 weeks, starting with $1 in the first week and increasing the amount by $1 each week. By the end of the year, you’ll have saved $1,378!

If the 5 Dollar Bill Challenge isn’t enough for you, why not try the 52 Week Money Challenge? The concept is simple: You save a certain amount of money each week for 52 weeks, starting with $1 in the first week and increasing the amount by $1 each week. By the end of the year, you’ll have saved $1,378!

Yes, saving money can be a fun challenge! It’s all about finding creative ways to make it more enjoyable and less stressful. And hey, who doesn’t love a good challenge?

The Savings Stash

So, what should you do with all that cash you’ve saved up? Well, the possibilities are endless! You could put it towards an emergency fund, pay off debt, invest it, or use it to treat yourself to something special. The choice is yours!

So, what should you do with all that cash you’ve saved up? Well, the possibilities are endless! You could put it towards an emergency fund, pay off debt, invest it, or use it to treat yourself to something special. The choice is yours!

Personally, I love the idea of putting it towards something that will further my financial future, like a down payment on a house or a retirement account. But there’s nothing wrong with treating yourself to a little something, like a fancy dinner or a weekend getaway.

Personally, I love the idea of putting it towards something that will further my financial future, like a down payment on a house or a retirement account. But there’s nothing wrong with treating yourself to a little something, like a fancy dinner or a weekend getaway.

The Final Countdown

The end of the year is always a great time to reflect on your goals and accomplishments. Imagine the feeling of satisfaction you’ll have when you’ve successfully completed the 5 Dollar Bill Challenge and have a nice chunk of change to show for it. Plus, you’ll have developed some great habits that you can carry with you into the new year and beyond!

The end of the year is always a great time to reflect on your goals and accomplishments. Imagine the feeling of satisfaction you’ll have when you’ve successfully completed the 5 Dollar Bill Challenge and have a nice chunk of change to show for it. Plus, you’ll have developed some great habits that you can carry with you into the new year and beyond!

So what are you waiting for, folks? Start the 5 Dollar Bill Challenge today and watch that savings stash grow. Who knows, maybe you’ll even start to enjoy saving money!

So what are you waiting for, folks? Start the 5 Dollar Bill Challenge today and watch that savings stash grow. Who knows, maybe you’ll even start to enjoy saving money!

The Bottom Line

Saving money can be tough, but it’s so important for our financial futures. The 5 Dollar Bill Challenge is just one fun and creative way to make it a little bit easier. So go ahead, give it a try, and let me know how it goes!

Saving money can be tough, but it’s so important for our financial futures. The 5 Dollar Bill Challenge is just one fun and creative way to make it a little bit easier. So go ahead, give it a try, and let me know how it goes!

Remember, saving money doesn’t have to be boring or stressful. With a little creativity and determination, you can turn it into a fun challenge that even your wallet will thank you for in the end!