Oh, hello there! Are you ready for something truly marvelous? Because I have something for you that’s going to knock your socks right off. I’m talking about the 2008 Form IRS 4506-T! I know, I know, you were probably hoping for something a little more exciting, but trust me on this one. This form is so amazing, it’ll make your head spin! And lucky for you, you can fill it out online, printable, fillable, and blank! Thanks, PDFfiller!

So What is the 2008 Form IRS 4506-T Anyway?

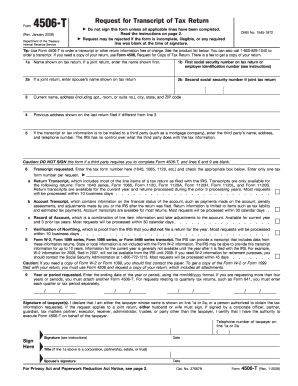

Before we get into the nitty-gritty details of this form, let’s take a moment to appreciate its beauty. Just look at those gorgeous lines and curves! But I digress. The 2008 Form IRS 4506-T, also known as the “Request for Transcript of Tax Return,” is a document that you may need to fill out if you want to get a copy of your tax return from the IRS. And let’s be honest, who doesn’t want to relive the exciting moments of tax season?

Before we get into the nitty-gritty details of this form, let’s take a moment to appreciate its beauty. Just look at those gorgeous lines and curves! But I digress. The 2008 Form IRS 4506-T, also known as the “Request for Transcript of Tax Return,” is a document that you may need to fill out if you want to get a copy of your tax return from the IRS. And let’s be honest, who doesn’t want to relive the exciting moments of tax season?

Why Should You Fill Out the Form?

Besides the obvious thrill of receiving a copy of your tax return, there are a number of reasons why you might need to fill out this particular form. For example, you may need to provide a copy of your tax return to your college or university in order to qualify for financial aid. Or maybe you’re applying for a mortgage or a loan, and your lender wants proof of your income. Whatever the reason, the 2008 Form IRS 4506-T is the key to unlocking your financial records.

How Do You Fill Out the Form?

Now comes the fun part: filling out the form! The good news is that you can do it all online, thanks to PDFfiller’s handy platform. You’ll need to provide some basic information, such as your name, social security number, and address. You’ll also need to specify which tax returns you want to receive, since the IRS keeps records for multiple years. And don’t forget to sign and date the form! Once you’ve filled everything out, simply submit it and wait for your transcript to arrive in the mail.

What Can You Expect After You’ve Submitted the Form?

After you’ve submitted the form, it may take a little while for the IRS to process your request. Depending on how busy they are, it could take anywhere from a few days to several weeks to receive your transcript. But once it arrives, you’ll finally have the key to unlocking your tax history! You can use the transcript to verify your income, file your taxes, or even just reminisce about the good old days of tax season.

Final Thoughts on the 2008 Form IRS 4506-T

I know what you’re thinking: “Wow, that was truly a life-changing experience.” And you’re not wrong! Filling out the 2008 Form IRS 4506-T may not be the most glamorous task on your to-do list, but it’s an important one. And thanks to PDFfiller, it’s also a lot easier than it used to be.

So go ahead, fill out that form with pride! Show the world just how much you love tax season. And who knows, maybe you’ll even inspire someone else to fill out their 2008 Form IRS 4506-T. Now wouldn’t that be something?