It’s time to start thinking about taxes again, and there are a lot of forms to keep track of. To help make things a little easier, I’ve put together a list of ten tax-related forms that you might need to fill out this year. Take a look!

2023 Form 1040-ES Payment Voucher

If you’re making estimated tax payments, you’ll want to have a Form 1040-ES Payment Voucher on hand. This form allows you to pay your estimated taxes using a check or money order, or you can submit your payment electronically with the IRS’s Direct Pay system. Make sure you fill out the voucher accurately, so your payment is properly applied to your account.

If you’re making estimated tax payments, you’ll want to have a Form 1040-ES Payment Voucher on hand. This form allows you to pay your estimated taxes using a check or money order, or you can submit your payment electronically with the IRS’s Direct Pay system. Make sure you fill out the voucher accurately, so your payment is properly applied to your account.

4 Tax Moves to Make in January 2021

January is the perfect time to start thinking about your taxes, even though Tax Day is still a few months away. This helpful article outlines four key tax moves you can make in January to help you save money and stay organized.

Schedule C Instructions 2022

If you’re a self-employed individual, you’ll likely need to fill out a Schedule C as part of your tax return. This form is used to report your business income or loss for the year. These instructions for Schedule C can help you understand how to fill out the form correctly.

If you’re a self-employed individual, you’ll likely need to fill out a Schedule C as part of your tax return. This form is used to report your business income or loss for the year. These instructions for Schedule C can help you understand how to fill out the form correctly.

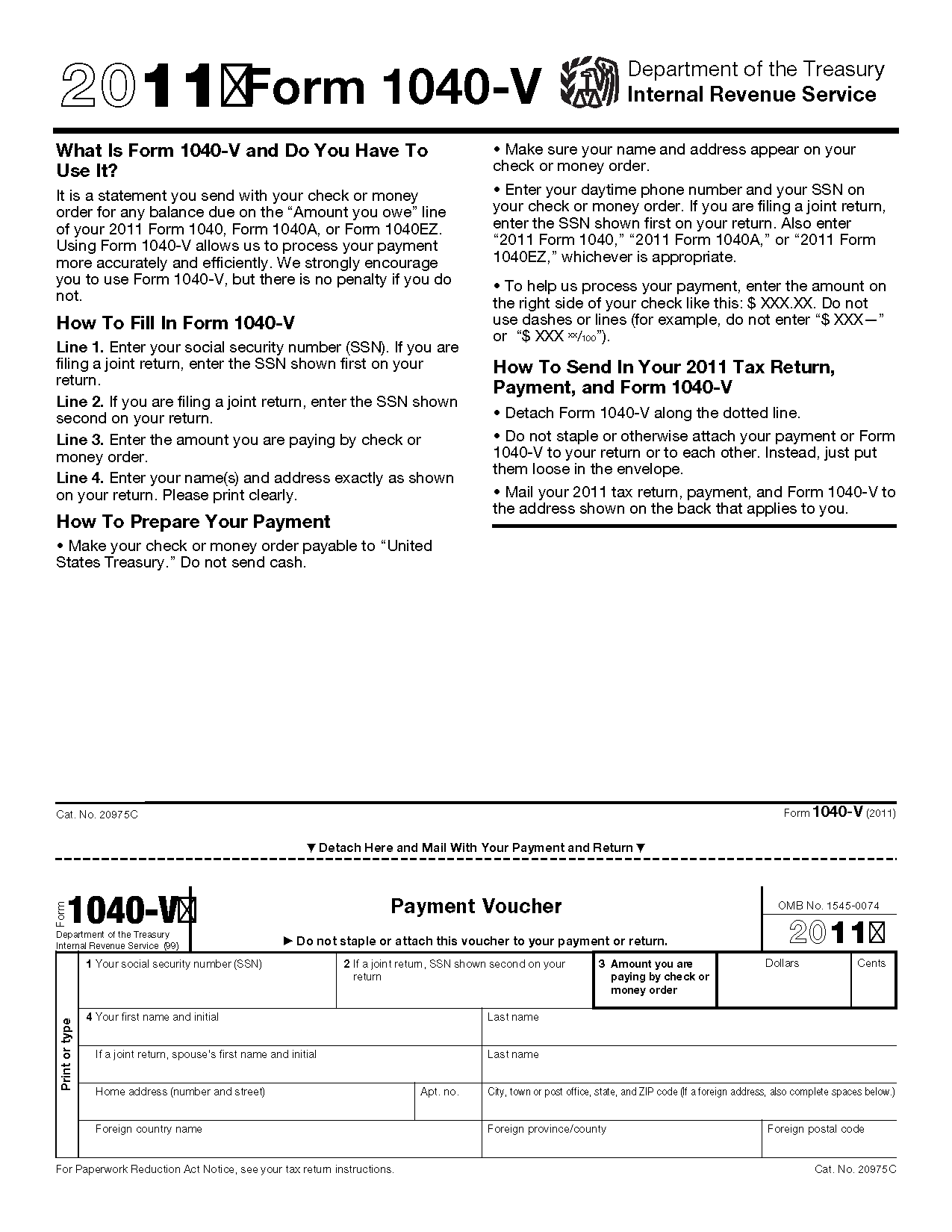

Form 1040 ES Payment Address

When you’re making estimated tax payments using a Form 1040-ES Payment Voucher, it’s important to send your payment to the correct address. This form includes the correct address for your payment, as well as additional instructions for filling out the voucher.

When you’re making estimated tax payments using a Form 1040-ES Payment Voucher, it’s important to send your payment to the correct address. This form includes the correct address for your payment, as well as additional instructions for filling out the voucher.

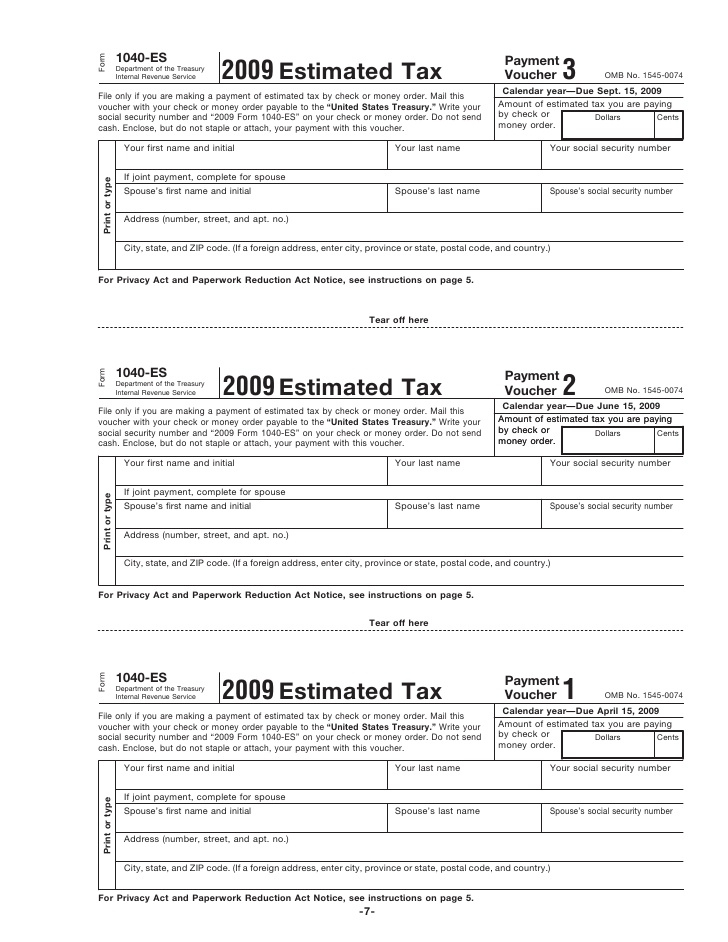

Form 1040-ES, Estimated Tax for Individuals

If you’re required to make estimated tax payments throughout the year, you’ll need to use Form 1040-ES to calculate your payments. This form can be tricky to fill out, so make sure you follow the instructions carefully. And don’t forget to hang onto your copies of the form for your records!

If you’re required to make estimated tax payments throughout the year, you’ll need to use Form 1040-ES to calculate your payments. This form can be tricky to fill out, so make sure you follow the instructions carefully. And don’t forget to hang onto your copies of the form for your records!

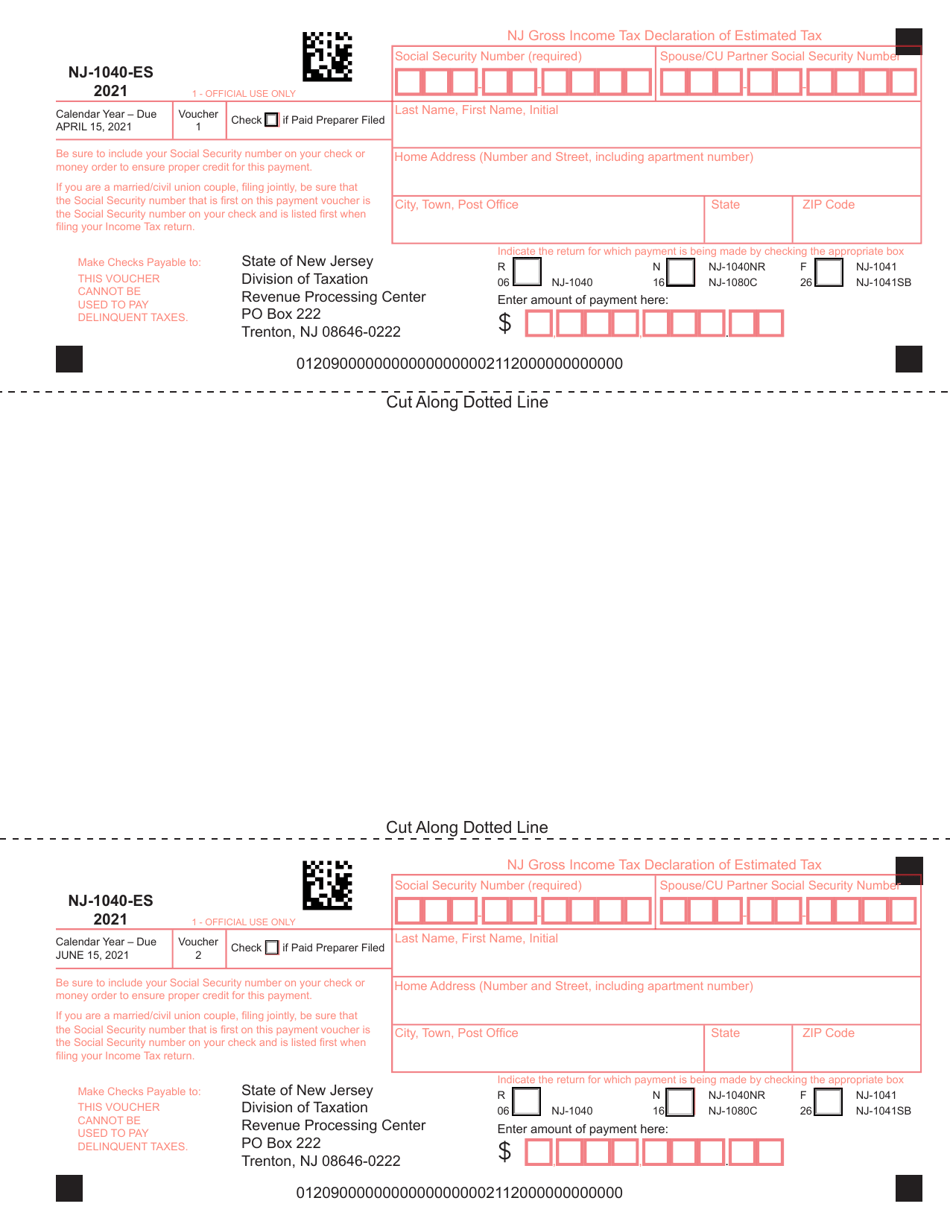

Form NJ-1040-ES Estimated Tax Voucher

If you live in New Jersey and you’re making estimated tax payments, you’ll need to use this form to make your payments. As with other payment vouchers, make sure you fill it out accurately and send it to the correct address to avoid any issues with your payments.

If you live in New Jersey and you’re making estimated tax payments, you’ll need to use this form to make your payments. As with other payment vouchers, make sure you fill it out accurately and send it to the correct address to avoid any issues with your payments.

2020 Form 1040-ES Payment Voucher

If you missed any estimated tax payments last year, you can use this voucher to catch up on your payments. Make sure you’re using the correct year’s voucher and follow the instructions carefully to avoid any issues.

If you missed any estimated tax payments last year, you can use this voucher to catch up on your payments. Make sure you’re using the correct year’s voucher and follow the instructions carefully to avoid any issues.

2020 Form 1040-ES Payment Voucher 1

This is another payment voucher for 2020 taxes, but it’s slightly different from the previous one. Make sure you’re using the correct voucher for your needs and follow the instructions carefully.

This is another payment voucher for 2020 taxes, but it’s slightly different from the previous one. Make sure you’re using the correct voucher for your needs and follow the instructions carefully.

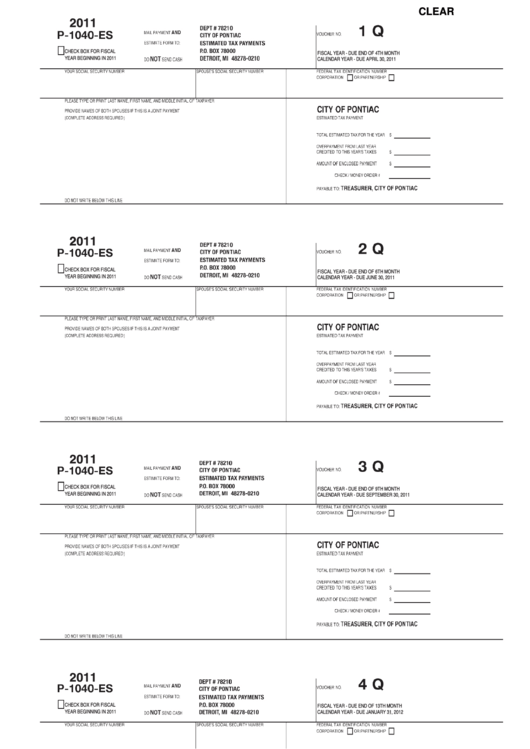

Fillable Form P 1040-ES Estimated Tax for Individuals

If you’re more comfortable filling out forms electronically, you can use this fillable PDF form to make your estimated tax payments. Just make sure you double-check all of your entries and save a copy of the form for your records.

If you’re more comfortable filling out forms electronically, you can use this fillable PDF form to make your estimated tax payments. Just make sure you double-check all of your entries and save a copy of the form for your records.

Form 1040 Estimated Payment Voucher 4

This payment voucher is specifically for the fourth estimated tax payment of the year. Make sure you’re using the correct voucher for your situation and that you’re sending your payment to the correct address.

This payment voucher is specifically for the fourth estimated tax payment of the year. Make sure you’re using the correct voucher for your situation and that you’re sending your payment to the correct address.

These ten tax forms are some of the most important ones you’ll need to keep track of as you prepare your taxes. Make sure you have all of the forms you need and double-check your work before submitting your return. And remember, if you have any questions about your taxes or filling out these forms, don’t hesitate to consult with a qualified tax professional.