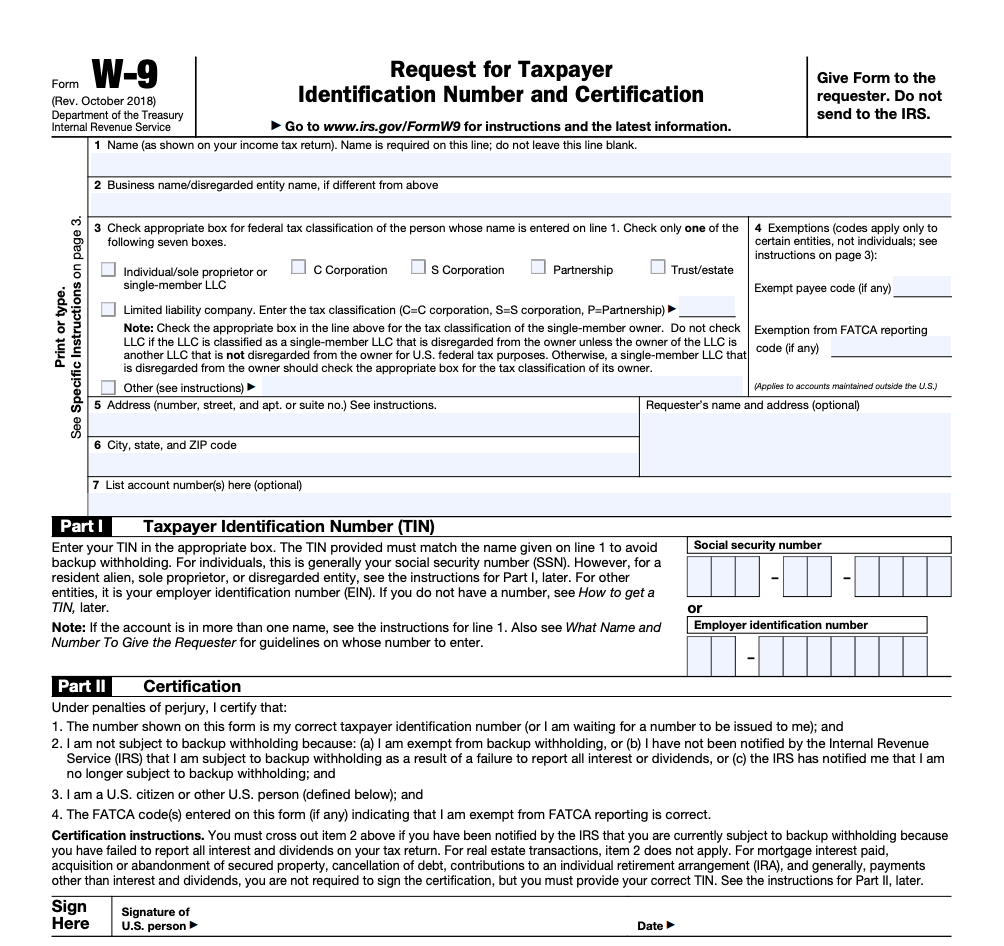

Forms like the 2020 W9 Blank Form are an essential part of doing business in the United States. This form, which is used for tax purposes, ensures that the appropriate amount of taxes are withheld and paid to the Internal Revenue Service (IRS).

What is a W9 Form?

A W9 Form is a form that is required by the IRS for businesses and individuals who receive certain types of income. The form is used to provide the necessary information to the IRS about the individual or company who is receiving the income so that the appropriate taxes can be withheld.

The form includes basic information like name, address, and tax identification number, and it’s important to make sure that all information is accurate and up-to-date. Failure to provide correct information on the W9 form can lead to fines or penalties from the IRS.

Why Do You Need a W9 Form?

If you’re a business owner, you’ll likely need to request a W9 form from some of your vendors and independent contractors. This is because the form is used to report certain types of income to the IRS.

For example, if you pay an independent contractor more than $600 over the course of a year, you’ll need to provide them with a W9 form and report that income to the IRS. This helps the IRS keep track of who is receiving income and ensures that everyone pays the appropriate amount of taxes.

How to Fill Out a W9 Form

Filling out a W9 form is a fairly straightforward process. The form itself is only one page long and includes several sections that need to be filled out.

Section 1: Name and Address

The first section of the form asks for your name and address. Make sure that all information is accurate and up-to-date, as this is the information that the IRS will use to contact you.

Section 2: Taxpayer Identification Number

The second section of the form asks for your taxpayer identification number. This is usually your Social Security Number (SSN) if you’re an individual or your Employer Identification Number (EIN) if you’re a business.

It’s important to make sure that this information is accurate, as it’s used by the IRS to identify you and ensure that you’re paying the appropriate amount of taxes.

Section 3: Exemptions

The third section of the form asks if you are exempt from backup withholding. Backup withholding is when a portion of your income is withheld by the person paying you and sent directly to the IRS. This is done as a safeguard in case you don’t pay your taxes.

If you’re not exempt from backup withholding, you’ll need to supply your employer or payer with another form of taxpayer identification, such as a W4 or W8 form.

Section 4: Signature

The final section of the form requires your signature, along with the date that you signed the form. By signing the form, you’re certifying that all information is accurate and that you’re not subject to backup withholding.

How to Submit a W9 Form

Once you’ve filled out your W9 form, you can submit it to your employer or payer. If you’re a freelancer or independent contractor, you’ll need to submit the form to each client that pays you more than $600 over the course of a year.

You should always keep a copy of your W9 form for your records, as you may need it for tax purposes in the future. It’s also a good idea to keep track of any income that you receive over the course of the year and report it to the IRS appropriately.

Conclusion

The 2020 W9 Blank Form is an important document for anyone who receives income in the United States. Filling out the form correctly and submitting it in a timely manner can help ensure that you’re not subject to fines or penalties from the IRS.

Even if you don’t receive income as an individual, it’s important to keep track of your taxes and report any income that you do receive. By doing so, you can stay on the right side of the law and avoid any unnecessary trouble with the IRS.

Remember, it’s always a good idea to consult with a tax professional if you have any questions or concerns about your taxes. They can help guide you through the process and ensure that you’re taking advantage of all available tax deductions and credits.

Remember, it’s always a good idea to consult with a tax professional if you have any questions or concerns about your taxes. They can help guide you through the process and ensure that you’re taking advantage of all available tax deductions and credits.