Do you find yourself confused between 1099-NEC and 1099-MISC? Well, you’re not alone. Many people struggle to understand the difference between these two forms, especially since the IRS has made some recent changes. So, let’s dive into what has changed and why it matters!

What is a 1099 form?

A 1099 form is a tax form used to report income that is not earned as an employee. This could include income earned as an independent contractor, rent or royalty payments, or other types of income earned outside of a typical employer-employee relationship. There are many different types of 1099 forms, but the most commonly used are the 1099-MISC and the 1099-NEC.

What is the difference between 1099-MISC and 1099-NEC?

The 1099-MISC has been used for many years to report non-employee compensation, such as payments made to independent contractors. However, beginning in 2020, the IRS introduced a new form called the 1099-NEC specifically for reporting non-employee compensation. This new form replaces Box 7 on the 1099-MISC, which was previously used for reporting non-employee compensation.

So, why did the IRS make this change? The main reason was to simplify the reporting process. By separating out non-employee compensation onto a separate form, the IRS hopes to reduce confusion and make it easier for taxpayers and businesses to accurately report their income.

Who needs to file a 1099-NEC?

Any business that pays non-employee compensation of $600 or more during the year is required to file a 1099-NEC. This includes payments made to independent contractors, freelancers, and other non-employees. If you’re unsure whether you need to file a 1099-NEC, it’s always a good idea to consult with a tax professional.

How do I fill out a 1099-NEC?

If you need to file a 1099-NEC, you can easily do so online using the IRS e-file system. You will need to provide your business information, the recipient’s information, and the amount of non-employee compensation paid. The IRS provides detailed instructions on how to fill out the form, so be sure to read them carefully.

What are the penalties for not filing a 1099-NEC?

If you are required to file a 1099-NEC and fail to do so, you may be subject to penalties. The penalty for failing to file can vary depending on how late you file, but it can be as much as $550 per form in some cases. If you intentionally disregard the filing requirements, the penalty can be even higher.

Conclusion

So there you have it – the difference between 1099-MISC and 1099-NEC, who needs to file a 1099-NEC, how to fill out the form, and the penalties for not filing. As always, it’s important to consult with a tax professional to ensure that you are accurately reporting your income and staying compliant with IRS regulations.

Images:

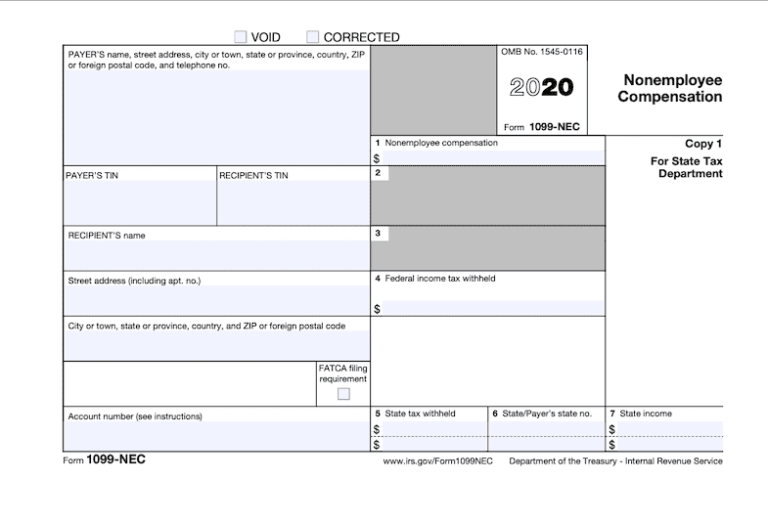

Image 1:

The 1099-NEC is a tax form used specifically for reporting non-employee compensation. It was introduced by the IRS in 2020 to simplify the reporting process.

The 1099-NEC is a tax form used specifically for reporting non-employee compensation. It was introduced by the IRS in 2020 to simplify the reporting process.

Image 2:

El formulario 1099 del IRS es un formulario de impuestos utilizado para informar ingresos que no se ganan como empleados. Esto podría incluir ingresos obtenidos como contratista independiente, pagos de alquiler o regalías, o cualquier otro tipo de ingreso obtenido fuera de una relación típica de empleador-empleado.

El formulario 1099 del IRS es un formulario de impuestos utilizado para informar ingresos que no se ganan como empleados. Esto podría incluir ingresos obtenidos como contratista independiente, pagos de alquiler o regalías, o cualquier otro tipo de ingreso obtenido fuera de una relación típica de empleador-empleado.

Image 3:

This image shows the IRS instructions for filling out the Form 1099-NEC. It’s important to follow these instructions carefully to ensure that you are accurately reporting your income.

This image shows the IRS instructions for filling out the Form 1099-NEC. It’s important to follow these instructions carefully to ensure that you are accurately reporting your income.

Image 4:

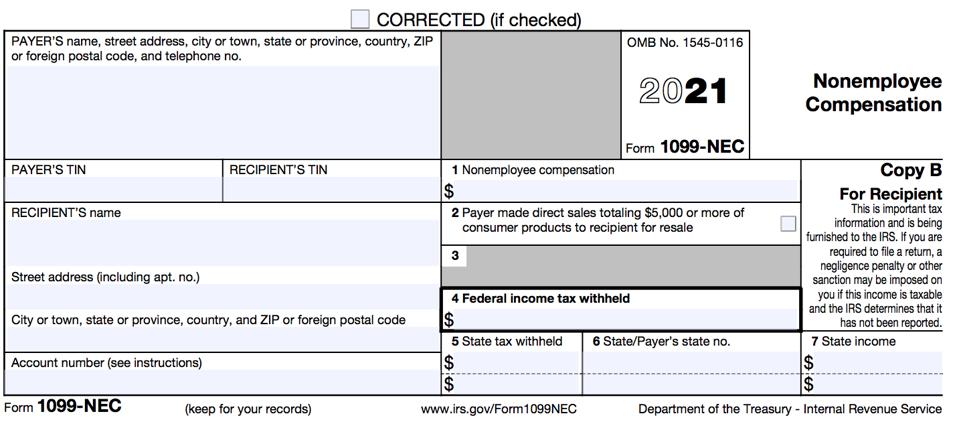

This image shows the 1099-NEC form for 2021. Make sure to use the most current version of the form when filing your taxes.

This image shows the 1099-NEC form for 2021. Make sure to use the most current version of the form when filing your taxes.

Image 5:

You can easily fill out the 2021 Form IRS 1099-NEC online using the pdfFiller system. Be sure to provide accurate information to avoid penalties.

You can easily fill out the 2021 Form IRS 1099-NEC online using the pdfFiller system. Be sure to provide accurate information to avoid penalties.

Image 6:

This image provides an overview of what Form 1099-NEC is and who needs to file it. If you’re unsure whether you need to file a 1099-NEC, consult with a tax professional.

This image provides an overview of what Form 1099-NEC is and who needs to file it. If you’re unsure whether you need to file a 1099-NEC, consult with a tax professional.

Image 7:

This image shows a fillable 1099 NEC form for 2020. Make sure to use the correct year’s form when filing your taxes.

This image shows a fillable 1099 NEC form for 2020. Make sure to use the correct year’s form when filing your taxes.

Image 8:

It’s important to use Form 1099-NEC to report non-employee compensation accurately. Failure to do so can result in penalties from the IRS.

It’s important to use Form 1099-NEC to report non-employee compensation accurately. Failure to do so can result in penalties from the IRS.

Image 9:

This image shows the Form 1099-NEC in more detail. Make sure to fill out the form accurately to avoid penalties.

Image 10:

If you need to file a 1099-NEC, you can easily do so online using the IRS e-file system. The system will provide you with a tax print-form to use when filing your taxes.

If you need to file a 1099-NEC, you can easily do so online using the IRS e-file system. The system will provide you with a tax print-form to use when filing your taxes.