Lately, I’ve been looking for an easy way to get my business tax forms in order and came across a great printable blank W 9 form. This form has made it so much simpler to keep my tax documents organized and up to date.

What is a W 9 form?

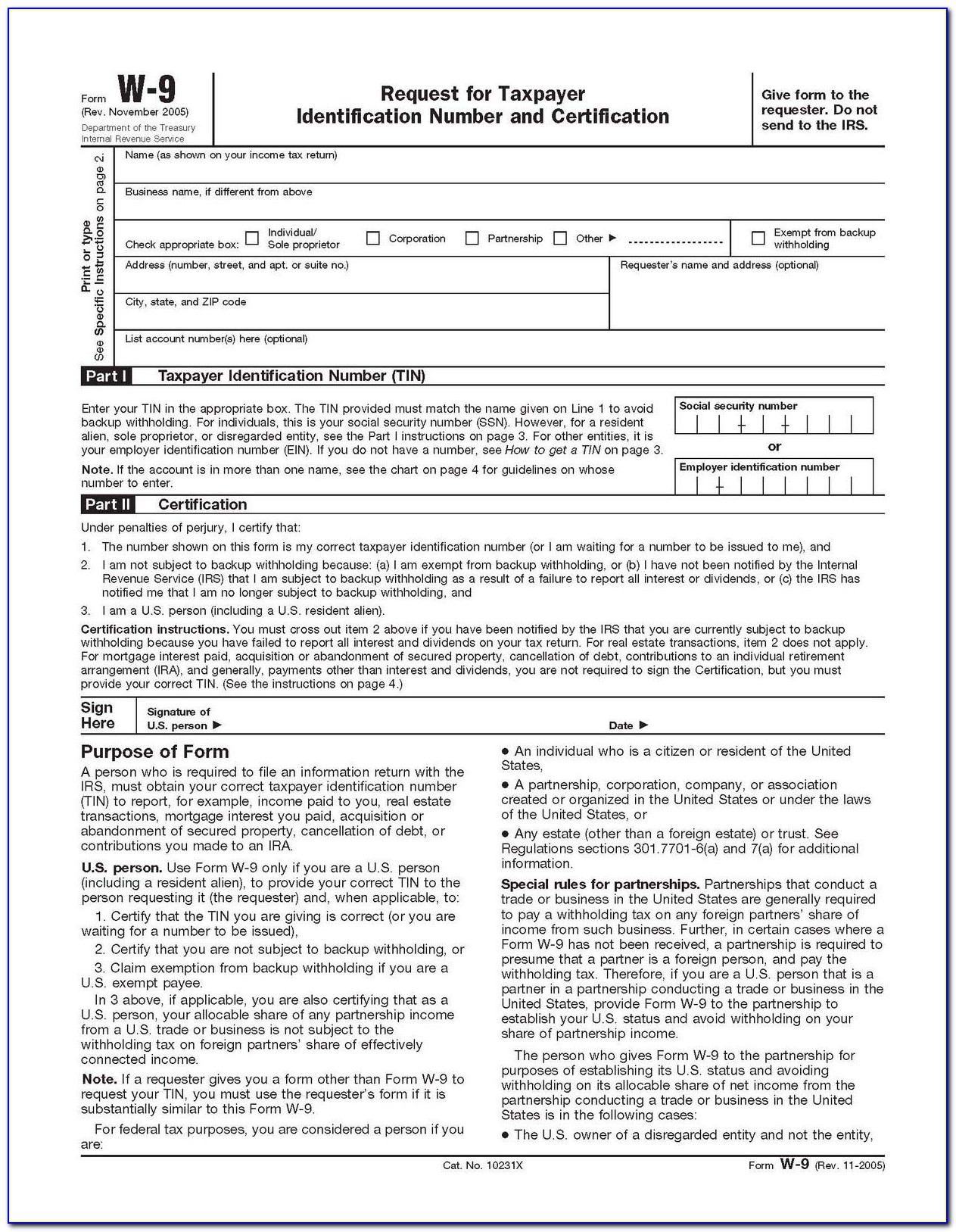

If you’re a freelancer or independent contractor, it’s likely that at some point you’ll be asked to fill out a W 9 form. This is a tax document that provides your information such as your name, business name, and taxpayer identification number (TIN), to the person or company that is paying you. It’s basically a request to know your taxpayer status for taxation purposes.

Why use a printable blank W 9 form?

Why use a printable blank W 9 form?

While it’s not difficult to fill out a W 9 form, having a printable blank W 9 form can make the process much quicker and smoother. You can easily print off a new form whenever needed, and make sure that all the information is accurate and complete. Plus, it’s a great way to stay organized and keep track of all your tax documents in one place.

How do I fill out a W 9 form?

Filling out a W 9 form is easy - just make sure you have all the information required before you start. You’ll need your name, business name, TIN, and the address associated with your TIN. Make sure to read through all the instructions and provide accurate and complete information. Once you’ve filled out the form, you can give it to the person or company that needs it.

Conclusion

If you’re an independent contractor or freelancer, a W 9 form is an important document that you’ll likely need to fill out at some point. Having a printable blank W 9 form can make the process much smoother and ensure that all of your tax documents are organized and up to date.

So if you’re looking for a simpler, more organized way to handle your tax documents, be sure to check out a printable blank W 9 form.