In modern society, managing one’s finances is increasingly important. From paying off bills to tracking expenses, keeping a steady eye on our finances can make all the difference between staying on budget and falling into debt. That’s why it’s important to utilize tools that can help simplify the process. One such tool is a check register.

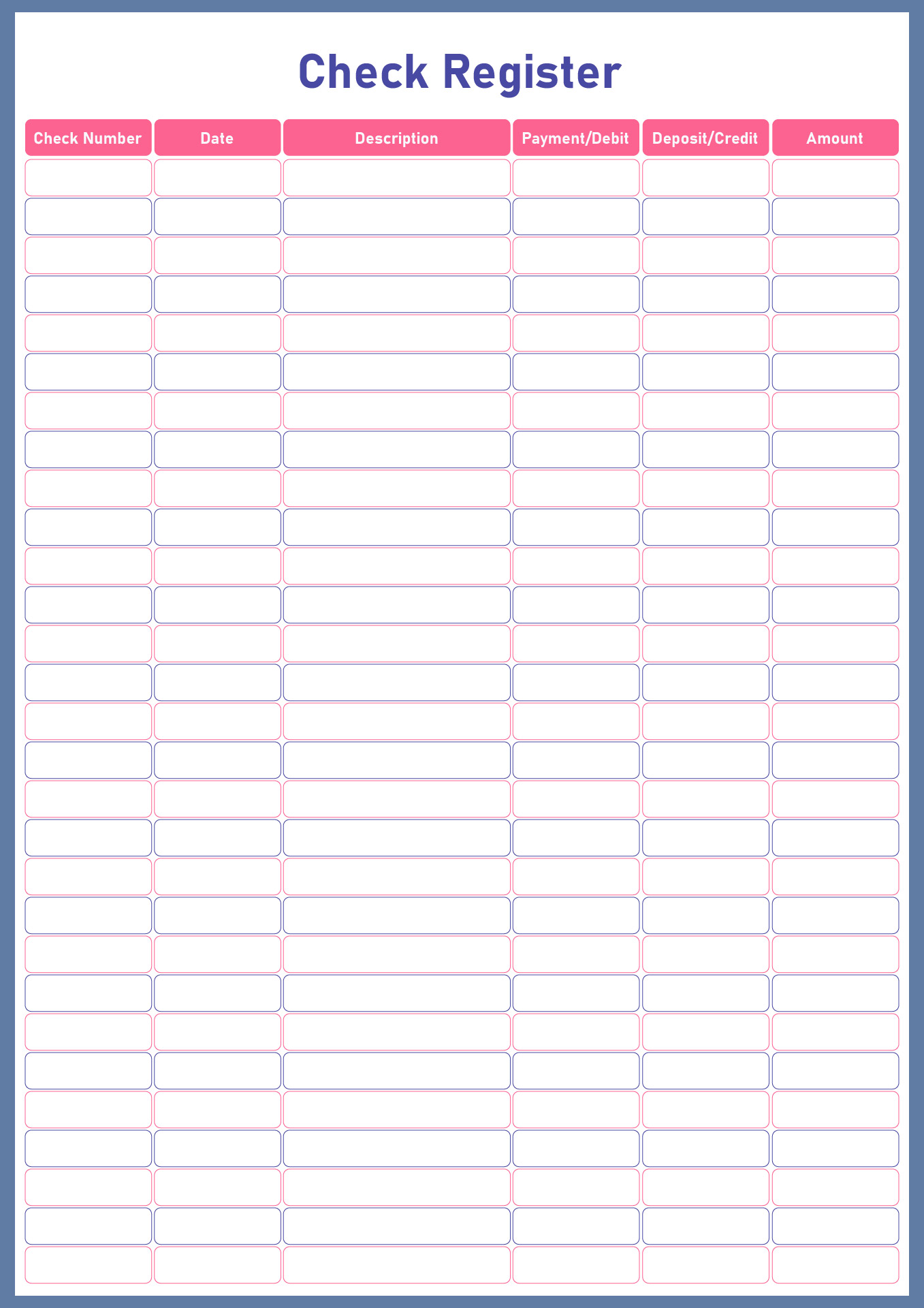

Free Printable PDF Check Register

A check register is a simple yet effective way to keep track of all your financial transactions. From writing checks to making online purchases, every time you spend or receive money, you record it in your check register. In doing so, you can easily monitor your bank account’s balance and ensure that you have enough funds to cover any expenses.

A check register is a simple yet effective way to keep track of all your financial transactions. From writing checks to making online purchases, every time you spend or receive money, you record it in your check register. In doing so, you can easily monitor your bank account’s balance and ensure that you have enough funds to cover any expenses.

Furthermore, check registers can help you identify any fraudulent activity in your account. By regularly updating your check register, you’ll be able to easily spot any unauthorized transactions and report them to your bank.

Benefits of Using a Check Register

For those who have never used a check register before, it may seem like an unnecessary hassle. However, there are plenty of benefits to using one:

- Improved financial organization

- Better understanding of your spending habits

- Reduced risk of overdraft fees

- Helpful tool for budgeting and financial planning

- Early detection of fraudulent activity

How to Use a Check Register

Using a check register is simple and straightforward. Here’s a step-by-step guide on how to get started:

- Obtain a check register: You can purchase a check register at a stationary store or bank, or you can create your own using a spreadsheet or printable template.

- Record transactions: Whenever you make a purchase or receive cash, record the transaction in your check register. Be sure to include the date, amount, payee, and transaction type (e.g. check, debit, credit).

- Calculate the balance: After each transaction, adjust your account balance in your check register accordingly. This will allow you to ensure that you always have enough funds to cover any expenses.

- Regularly review your check register: Take a few minutes each week to review your check register and ensure that all transactions have been properly recorded. Check for any discrepancies and correct them immediately.

Free Printable Check Registers

For those who prefer a paper copy of their check register, there are plenty of free printable templates available online. Here are a few of the best:

1. Vertex42

Vertex42 offers a free printable check register template that can be customized to fit your needs. The template includes a bank reconciliation form, which can be used to compare your records with your bank statement and ensure that there are no discrepancies. Additionally, the template is available in both Excel and PDF formats.

Vertex42 offers a free printable check register template that can be customized to fit your needs. The template includes a bank reconciliation form, which can be used to compare your records with your bank statement and ensure that there are no discrepancies. Additionally, the template is available in both Excel and PDF formats.

2. Printablee

Printablee offers several different check register templates, including options for personal and business accounts. The templates are available in PDF format and can be downloaded and printed for free.

Printablee offers several different check register templates, including options for personal and business accounts. The templates are available in PDF format and can be downloaded and printed for free.

3. BrightHub

BrightHub offers a simple yet effective check register template that’s perfect for those who prefer a minimalist design. The template includes columns for the date, check number, description, debit, and credit, and can be downloaded in Excel format.

BrightHub offers a simple yet effective check register template that’s perfect for those who prefer a minimalist design. The template includes columns for the date, check number, description, debit, and credit, and can be downloaded in Excel format.

Conclusion

Overall, a check register is a valuable tool for anyone looking to stay on top of their finances. By properly recording all financial transactions, you’ll be able to monitor your account balance and identify any unauthorized activity. Furthermore, using a check register can help you better understand your spending habits and stay within your budget, ultimately leading to improved financial stability.