Have you ever thought about what happens if you become unable to handle your financial affairs due to an illness or any other reason? If you live in Pennsylvania and want to protect your interests, a durable financial power of attorney can be helpful. This legal document allows you to grant someone else (your agent) the authority to manage your financial affairs and make decisions on your behalf. No matter who you choose as your agent, it’s important to understand that this person will be able to access your bank accounts, investments, and other assets.

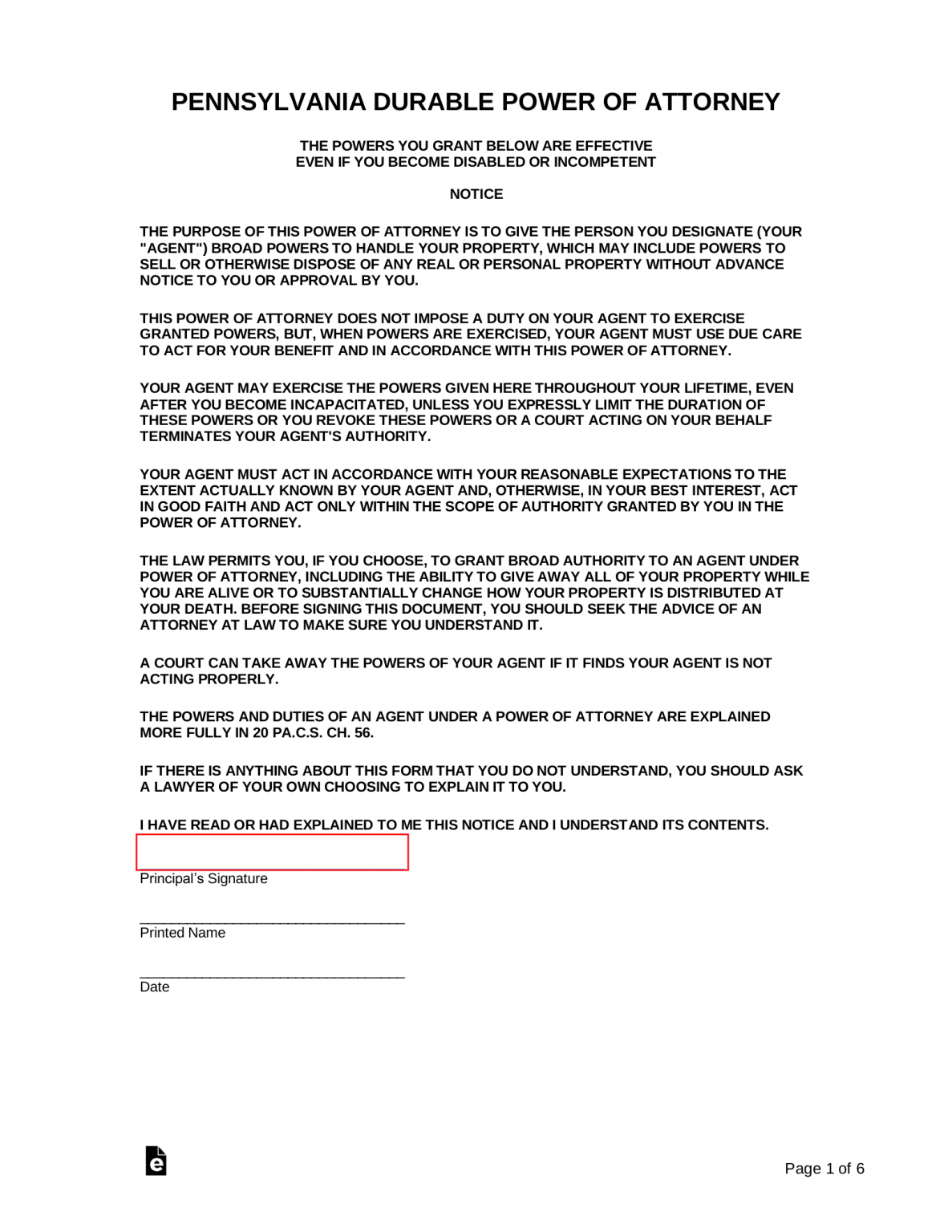

Free Pennsylvania Durable (Financial) Power of Attorney Form - PDF

This durable financial power of attorney form is designed to meet the legal requirements of the Commonwealth of Pennsylvania. It allows you to designate an agent to act on your behalf in a variety of financial matters, including but not limited to banking, investments, real estate transactions, and taxes. You can also use this form to specify the powers you want your agent to have and limitations on those powers. Keep in mind that you can revoke or modify this power of attorney at any time, as long as you are competent to do so.

This durable financial power of attorney form is designed to meet the legal requirements of the Commonwealth of Pennsylvania. It allows you to designate an agent to act on your behalf in a variety of financial matters, including but not limited to banking, investments, real estate transactions, and taxes. You can also use this form to specify the powers you want your agent to have and limitations on those powers. Keep in mind that you can revoke or modify this power of attorney at any time, as long as you are competent to do so.

While it’s possible to create a durable financial power of attorney on your own using online forms or templates, it’s recommended that you consult a lawyer. An attorney can ensure that the document is tailored to your specific needs and complies with Pennsylvania law. Moreover, an attorney can advise you on the potential pitfalls of granting someone else access to your financial affairs and suggest safeguards to prevent abuse or fraud.

Protecting Your Interests with a Durable Financial Power of Attorney

One of the primary reasons to create a durable financial power of attorney is to protect your interests in case of incapacity. If you become unable to manage your finances due to illness or injury, your agent can step in and pay your bills, manage your investments, collect your Social Security or other benefits, and make other financial decisions on your behalf. This can provide peace of mind knowing that your financial affairs are being handled by someone you trust. Without a durable financial power of attorney in place, your loved ones may have to go to court to obtain a guardianship or conservatorship over your affairs, which can be time-consuming, expensive, and emotionally draining.

Another benefit of a durable financial power of attorney is that it allows you to plan for the future. For example, if you are planning to move to a different state or country, you may want to grant someone else the authority to manage your finances in your absence. Or, if you own a business or have complex investments, you may want to designate an agent with the expertise to handle these matters. By creating a durable financial power of attorney, you can ensure that your wishes are carried out and your assets are protected.

Choosing Your Agent

The person you choose as your agent should be someone you trust implicitly and who has your best interests at heart. In most cases, people choose a spouse, adult child, or close friend as their agent. However, you can also appoint a professional, such as a lawyer or accountant, if you prefer. Keep in mind that your agent will have access to your financial affairs and will be making decisions on your behalf, so it’s important to choose someone who is responsible, reliable, and competent to handle these tasks. You may also want to choose an alternate agent in case your first choice is unable or unwilling to serve.

When choosing your agent, it’s also important to consider any potential conflicts of interest. For example, if you own a business, you may want to choose an agent who is not involved in the business. Similarly, if you have multiple beneficiaries to your estate, you may want to choose an agent who is not a beneficiary. This can help avoid the appearance of impropriety and ensure that your agent is acting in your best interests rather than their own.

The Powers Granted to Your Agent

The powers granted to your agent under a durable financial power of attorney can be as broad or as limited as you choose. You may want to consider the following factors when determining the scope of your agent’s powers:

- The types of assets and investments you own

- Your anticipated income and expenses

- Any debts or liabilities you have

- Your estate plan

Some of the powers that you may grant to your agent include:

- Banking and financial transactions

- Investments and securities

- Real estate transactions

- Insurance policies

- Tax matters

- Government benefits

- Legal claims and litigation

- Business operations

It’s important to note that under Pennsylvania law, certain powers must be specifically granted in the durable financial power of attorney form. For example, your agent must be authorized to create trusts on your behalf and to make gifts, unless those powers are expressly excluded. Similarly, your agent may not make any decisions regarding your health care or end-of-life decisions, unless you also have a separate health care power of attorney.

Safeguarding Against Abuse and Fraud

While a durable financial power of attorney can be a valuable tool for protecting your financial interests, it’s important to be aware of the potential for abuse or fraud. Unfortunately, there have been cases where agents have taken advantage of their authority to steal from or otherwise harm the principal (the person who created the power of attorney). To minimize the risk of abuse or fraud, you may want to consider the following safeguards:

- Choose an agent who is trustworthy and responsible

- Limit your agent’s powers to only what is necessary

- Require your agent to keep detailed records of all transactions

- Require your agent to provide you with regular reports

- Require a bond or insurance to protect against losses

- Include a provision to revoke the power of attorney if necessary

- Have an attorney review the document to ensure compliance with the law

By taking these steps, you can help prevent abuse or fraud and ensure that your financial affairs are protected. Remember, a durable financial power of attorney can be an important part of your estate plan and can provide peace of mind knowing that your interests will be taken care of in case of incapacity.