Starting with a proper budget planner is one of the smartest things you can do for your finances. It’s easy to let expenses get out of control, but with the help of the right tools, you can easily keep your spending in check and work towards your financial goals. Luckily, there are tons of budget planner options out there, including some great free printable ones like the one we found at Cute Freebies For You!

Budget Planner Free Printable

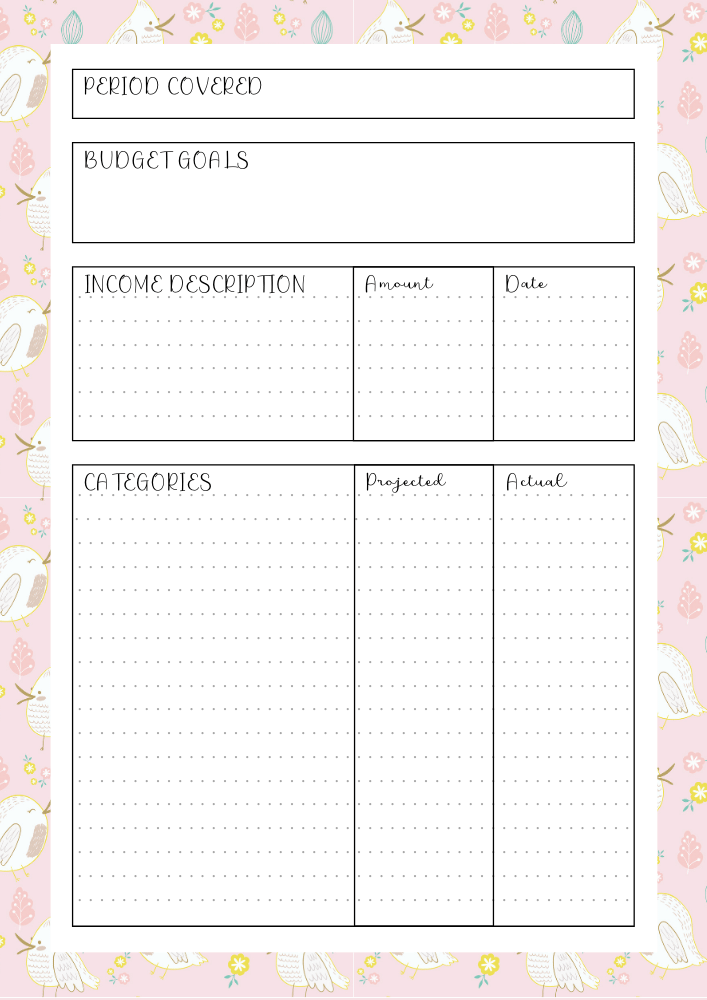

If you’re new to budget planning or looking for a fresh start, this printable sheet is a great place to begin. It’s simple and easy to use, with just a few key sections to help you stay on track with your finances.

If you’re new to budget planning or looking for a fresh start, this printable sheet is a great place to begin. It’s simple and easy to use, with just a few key sections to help you stay on track with your finances.

Income

Start by tracking your income for the month. This includes your regular pay, any side hustle income, and other sources of funds. Write down each source and the amount you expect to receive. This section will give you a clear picture of what funds you have to work with for the month ahead.

Fixed Expenses

Next, list out your fixed expenses. These are bills and expenses that remain the same each month, such as rent or mortgage payments, car payments, insurance premiums, and more. Write down the name of the expense and the amount due each month. This section will give you an idea of your monthly obligations, and allow you plan ahead for these expenses.

Variable Expenses

Variable expenses are those that fluctuate from month to month. Examples include groceries, entertainment, and shopping. Estimate what you’ll spend on these expenses for the month, including a buffer for any surprises or unexpected expenses. It’s best to be conservative with your estimates in this section so you don’t end up over-spending for the month.

Savings Goals

Finally, set aside space on your budget planner for your savings goals. This can include setting aside money for an emergency fund, planning for a vacation, or setting aside funds for a big purchase. Whatever your savings goals are, write them down and include the amount you want to set aside each month to work towards them.

Why a Budget Planner is Essential

If you’ve never used a budget planner before, you might be wondering why it’s so essential. There are a lot of benefits to budget planning, but here are just a few:

Keeps You Focused

When you have a clear picture of your income and expenses for the month, you’re more likely to stay focused on your financial goals. Without a budget, it’s easy to overspend or lose track of where your money is going. A budget planner helps you keep your spending in check and makes it easier to say “no” to unnecessary expenses that would otherwise throw your budget off track.

Helps You Plan Ahead

With a budget planner, you can plan ahead for expenses that are coming up. This means you’re less likely to be blindsided by unexpected expenses and can avoid going into debt just to cover them. You’ll know exactly what bills are coming up, when they’re due, and how much you need to set aside for them.

Encourages Better Spending Habits

When you’re more aware of your spending, you’re more likely to develop better spending habits. You’ll be less focused on impulse purchases and more focused on purchasing things that align with your financial goals. Having a budget planner also makes it easier to prioritize your spending. If you know you want to save up for a new car, for example, you’ll be more likely to put off smaller purchases in order to save money more quickly.

Tips for Successful Budget Planning

Now that you know why a budget planner is so essential, here are a few tips to help you make the most of your budget planning:

Be Realistic

When you’re estimating expenses, it’s important to be realistic. Don’t underestimate how much you’ll spend on groceries, for example, or you may find yourself in a bind later on. At the same time, be conservative in your estimates so that you aren’t overspending in any one area.

Track Every Expense

The more diligent you are about tracking your expenses, the more successful you’ll be with budget planning. Make sure you keep a record of every expense, even small ones, so that you can see where your money is going each month. This can help you identify areas where you may be overspending or areas where you can cut back.

Adjust as Needed

Your budget planner should be a living document that you adjust as needed. If you find that you’re consistently overspending in one area, for example, you may need to reevaluate your budget and adjust accordingly. Don’t be afraid to make changes as needed in order to ensure that your budget is working for you.

Start Budget Planning Today!

If you’re ready to take control of your finances, a budget planner is a great place to start. This free printable planner from Cute Freebies For You is a simple and easy-to-use option that can help you get organized and make the most of your money. Get started today and see how much easier it is to stay on track with your finances!

In conclusion, budget planning is essential to managing your finances. With the right tools, like a budget planner, you can easily keep your spending in check and work towards your financial goals. Use the tips listed above to make the most of your budget planning, and don’t be afraid to adjust your plan as needed. With a little effort and diligence, you can achieve financial success!