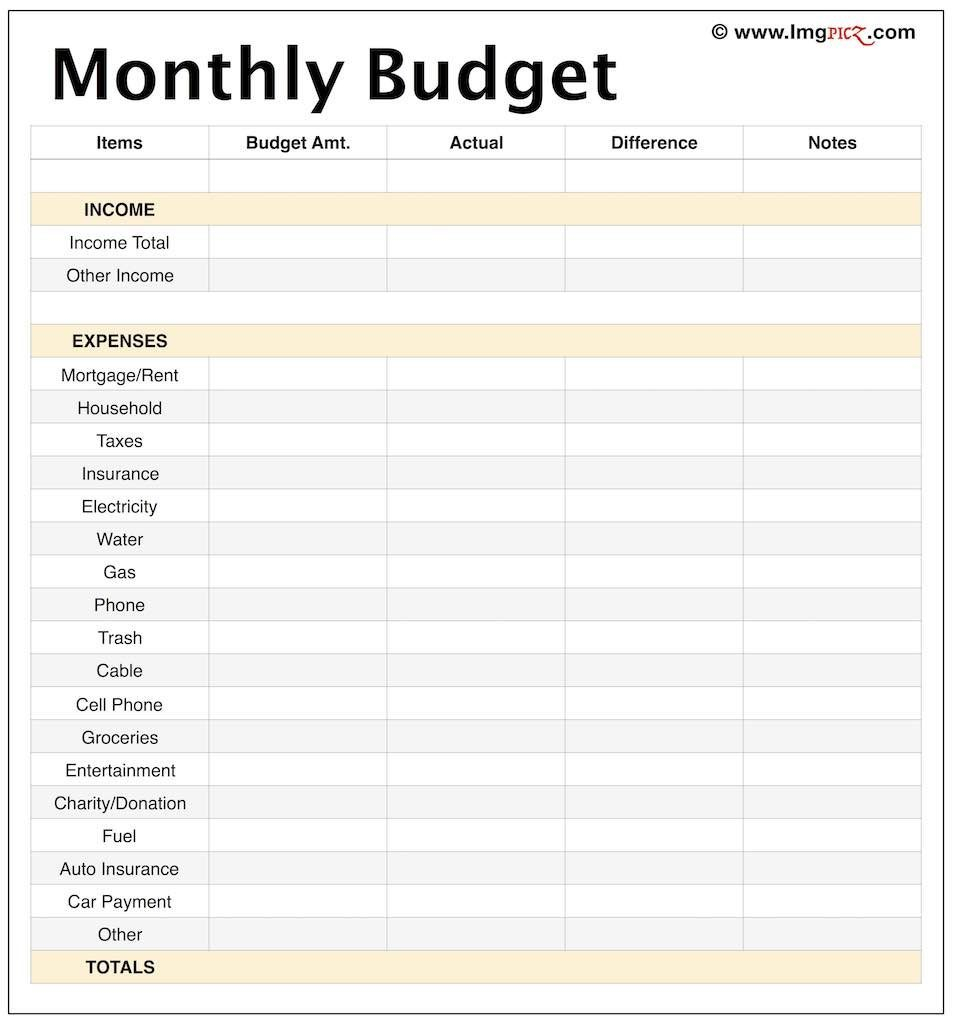

Have you been struggling to keep track of your finances lately? No need to worry as we have found the perfect solution for you! We stumbled upon a blank budget spreadsheet that is free to print and use to manage your money effectively. Firstly, let’s take a look at the image below which showcases the blank budget spreadsheet we are talking about.

Blank Budget Spreadsheet

This budget worksheet has a variety of categories such as housing, transport, food, entertainment and many more to help you categorize your expenses. The template is easy to navigate and customize according to your needs. We understand that budgeting can be quite exhausting, but with this template, you can easily take control over your expenses and achieve your financial goals. It’s important to keep track of our finances and keep our expenses in check, especially during this global pandemic where job security and financial stability have been affected. Managing your money may sound complicated, but the blank budget spreadsheet simplifies the process by providing separate categories for all expenses, making it easier for you to track your spending habits. Here are a few steps to get started with using the blank budget spreadsheet: Step 1: List all your income sources

Before you begin, it is important to have a clear understanding of all the sources of income going into your account. This includes your monthly salary or any other sources of income such as freelancing, part-time jobs, etc. Once you have a clear idea of your income sources, input the values into the “Income” section of the template. Step 2: List all your expenses

Now it’s time to list down all your expenses for the month. Start with the essentials such as rent, groceries, utilities, transport, etc. Then move on to other categories such as entertainment, clothes, travel, etc. The template provides various categories, and you can add or remove your own categories based on your requirements. Step 3: Categorize your expenses

Once you have listed down all your expenses, categorize them under the appropriate headings. For example, under the “Utilities” category, you can list down your monthly electricity and gas bills. Similarly, under the “Transport” category, you can list down your monthly car loan installment payments, car insurance, fuel costs, etc. Step 4: Input the values in the template

Now it’s time to input the values in the template. Once you have all the income and expenses values, fill them in the respective sections of the budget worksheet. The template will then automatically calculate the sums for each category, and you will get a clear overview of your monthly expenses. Step 5: Analyze your spending habits

The blank budget spreadsheet not only helps you manage your finances but also provides insights into your spending habits. Analyzing your spending habits can help you identify areas where you can cut back on your expenses and save more money. For instance, if you find that you spend a considerable amount of money on dining out or entertainment, you can try to reduce or limit these expenses and save that extra amount. Similarly, if you find that your electricity bill is too high, you can try to be more mindful of your energy usage and switch to more energy-efficient options. In conclusion, the blank budget spreadsheet is an excellent tool for anyone struggling to keep track of their finances. With its user-friendly interface and comprehensive categories, managing your monthly expenses becomes more manageable and less time-consuming. Plus, by analyzing your spending habits, you can identify areas where you can save more money and improve your financial health in the long term. Give it a try and see the difference it can make!