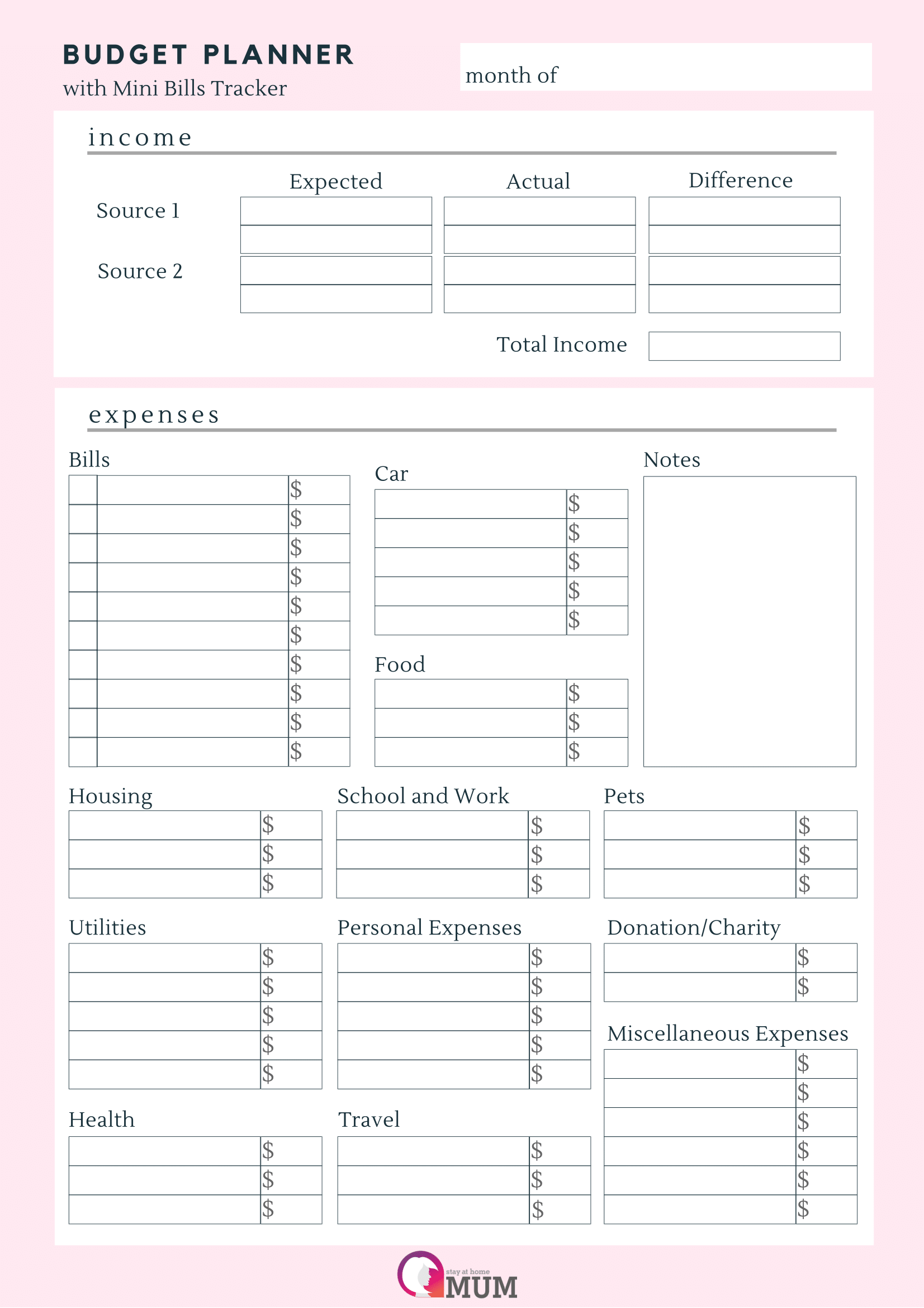

A budget planner with a mini bills tracker is a great tool for managing your finances. By using this free printable, you can keep track of your bills and expenses and stay on top of your spending. This budget planner helps you to set financial goals, track your income and spending, and plan for the future.

Benefits of Using a Budget Planner

Using a budget planner has numerous benefits. It can help you to:

- Reduce your debt

- Save money for emergencies, vacations, or other goals

- Manage your bills more effectively

- Make informed financial decisions

- Eliminate unnecessary expenses

How to Use the Budget Planner

The budget planner is easy to use. To get started:

- Download and print the budget planner

- List all of your income sources, such as your salary, investments, or rental income

- List all of your expenses, such as your rent or mortgage, utilities, groceries, entertainment, and transportation costs

- Allocate your income to your various expenses

- Track your spending and update your budget planner regularly

How to Use the Mini Bills Tracker

The mini bills tracker is a great tool for keeping track of your bills and due dates. To use the mini bills tracker:

- List all of your bills and their due dates

- Tick off each bill as you pay it

- Update the mini bills tracker regularly

Tips for Using the Budget Planner and Mini Bills Tracker

Tips for Using the Budget Planner and Mini Bills Tracker

Here are some tips for using the budget planner and mini bills tracker effectively:

- Set realistic financial goals

- Track your spending and update your budget planner regularly

- Use your budget planner to make informed financial decisions

- Avoid unnecessary expenses

- Stick to your budget as much as possible

Conclusion

A budget planner with a mini bills tracker is a powerful tool for managing your finances. By using this free printable and following the tips and guidelines outlined above, you can take control of your finances, reduce your debt, and achieve your financial goals. So why wait? Download the budget planner today and start your journey to financial freedom!